Lending, Debt, & Equity

Collateral360®: Manage Property Due Diligence and Compliance from One Dashboard

From appraisal procurement and environmental reports to flood certificates, and more, Collateral360 is a web-based application helping lenders better manage critical processes, risk, and compliance. As a compliance tool, Collateral360 allows lenders to build their policy into their workflow, ensuring each loan is managed to credit and risk policy.

Benefits

Accelerate loan approvals

Reduce loan origination time by streamlining tasks across your entire enterprise, all managed in one secure SaaS environment.

Comply with excellence

Manage ever-changing workstreams, projects and portfolios, all while providing a wide range of capabilities.

Control lending risk

Incorporate lending policies into your workflow, ensuring each transaction is managed to credit, risk and regulatory standards.

Oversee vendor management

Oversight of an approved catalog of preferred partners that allows for a simplified ordering process of additional services.

Features

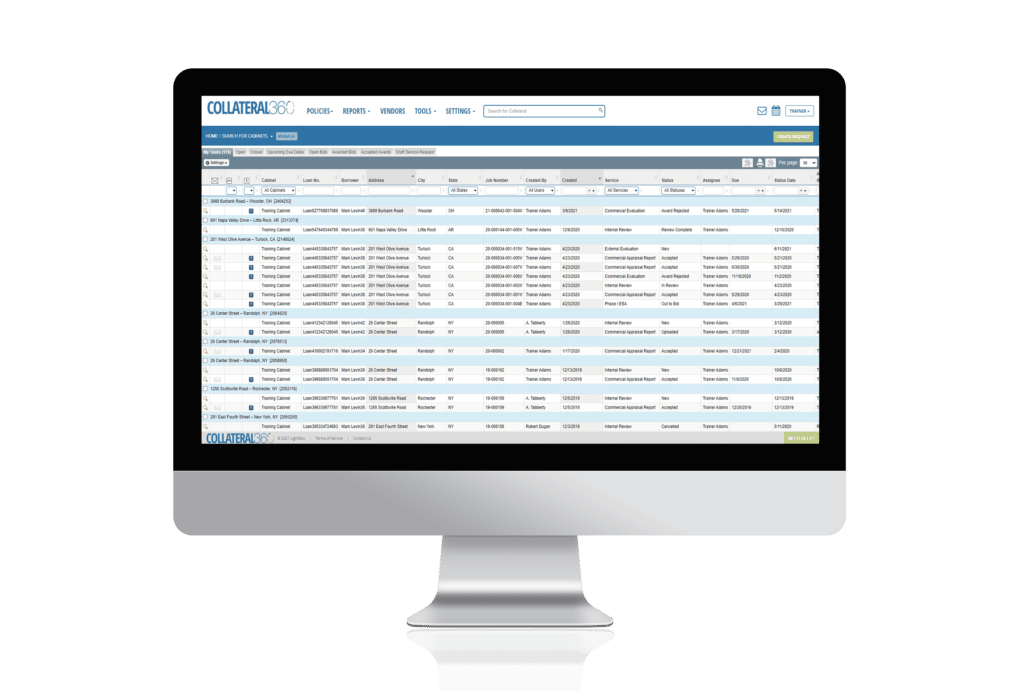

Streamline Your Workflow

Significantly improve your loan management workflow by performing every task from a single dashboard:

- Streamlined invoice management

- Customizable online review memo

- Trigger on status, automation of services

- Task management-routing rule automation

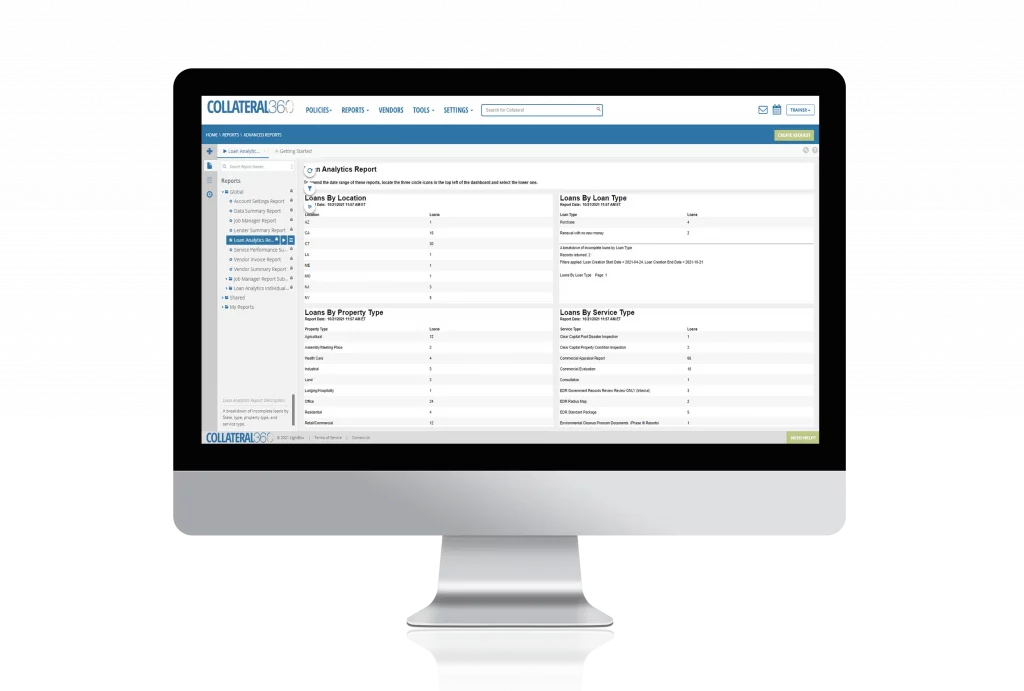

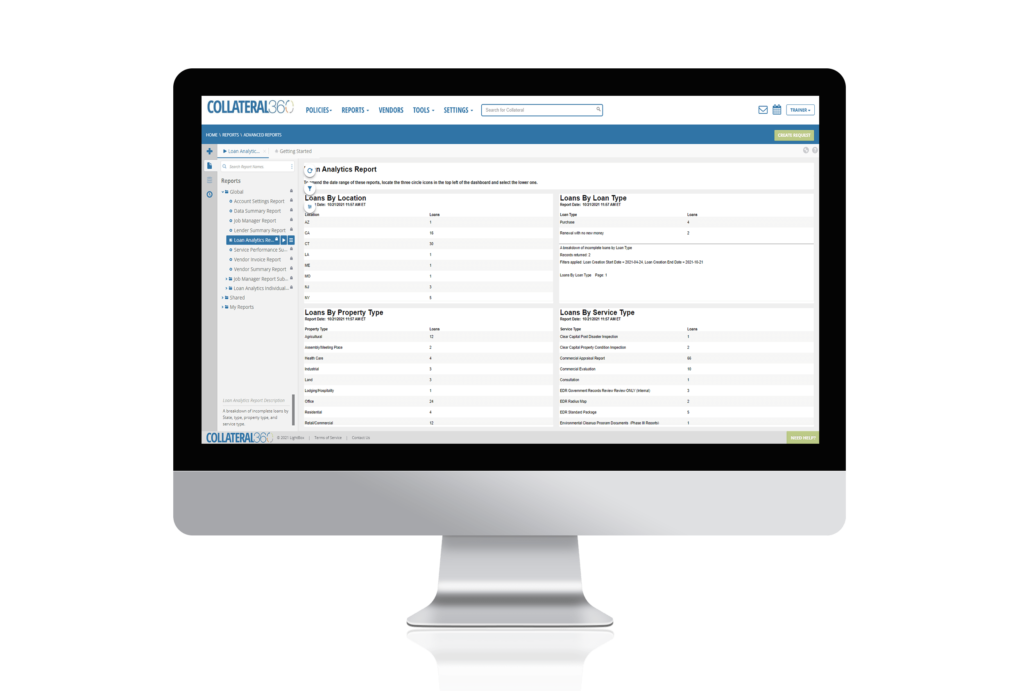

Compliance Management

Easily manage compliance and regulatory risk, including:

- Comprehensive vendor management

- Robust reporting capabilities

- Documented appraisal delivery and amendments

- Track communication with all parties associated with the loan file

- Easily meet FIRREA and other requirements

Integrated Third-Party Reports

Comprehensive built-in vendor marketplace. Order all data services needed to manage your due diligence and procurement, such as:

- Appraisal and Environmental Reports

- Site inspections

- Exterior/interior inspections

- Evaluations

- Flood certificates

Trusted, Comprehensive Environmental Data

Easily screen properties for environmental issues:

- Instantly identify any environmental concerns and plot their location in relation to the property using our environmental database–the largest in the nation.

- Identify risk as being low or elevated using our algorithm-based opinion generator.

LightBox Fundamentals

LightBox Fundamentals: AI-Powered Appraisal Intelligence for Lenders

LightBox Fundamentals transforms static commercial appraisal documents into structured, searchable data delivered instantly via an Excel Add-In. Powered by AI, it eliminates manual data entry, reduces turnaround times, and brings portfolio-level insights to credit, risk, and compliance teams.

- High Accuracy

Powered by a custom AI + Heuristic Engine trained solely on narrative appraisals - Real-Time Excel Integration

For instance access to 80+ key fields and metrics - Zero Setup Needed

Minimal learning curve, realize immediate value

LightBox Marketplace

The industry’s only marketplace connecting lenders and vendors directly, making it the largest and most powerful platform of its kind. With unmatched scale and reach, we facilitate millions in fees associated with transactions annually.

Our LightBox Marketplace is a vendor-agnostic, digital platform uniquely designed to connect LightBox Lenders with a network of vetted 3rd Party Vendors, providing non-procuring report services (i.e. Evaluations or inspections).

Why Our Lenders Love It: