Lending, Debt, & Equity

The Top Two Lending Due Diligence Solutions

When it comes to managing risk, third-party vendors, and appraisal workflows, choosing the right platform is critical for long-term success. LightBox’s RIMS® and Collateral360® have 15-year track records of being the industry’s leading platforms, trusted by over 1,200 lending institutions and their Chief Appraisers, to manage the ever-changing regulatory landscape, and meet your most challenging needs.

The top two lending due diligence and procurement systems in the industry

8 out of 10

of the top U.S. banks use LightBox

25+

years in business

1,200+

banks on our platforms

$90B+

in loans processed every year

Products Designed by Lenders, For Lenders

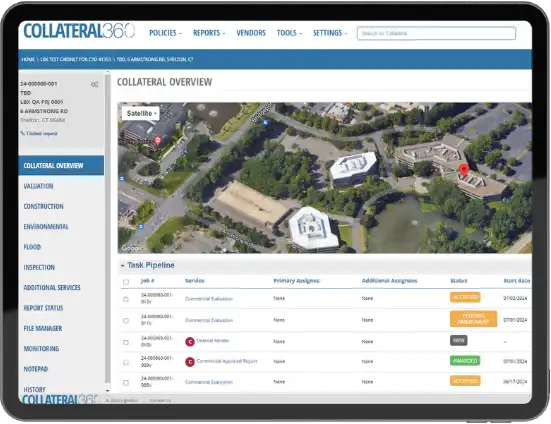

Collateral360 is your all-in-one collateral management platform, designed to streamline the appraisal, environmental, and flood compliance processes. With Collateral360, you can:

- Centralize Data: Access all relevant property information in one place, reducing the time spent on gathering data from multiple sources.

- Ensure Compliance: Stay ahead of regulatory requirements with integrated compliance tools that reduce the risk of costly mistakes.

- Enhance Workflow Efficiency: Automate key processes, from ordering services to reviewing reports, saving time and resources.

- Integrate Seamlessly: Integrate with your existing systems for a smooth, uninterrupted workflow.

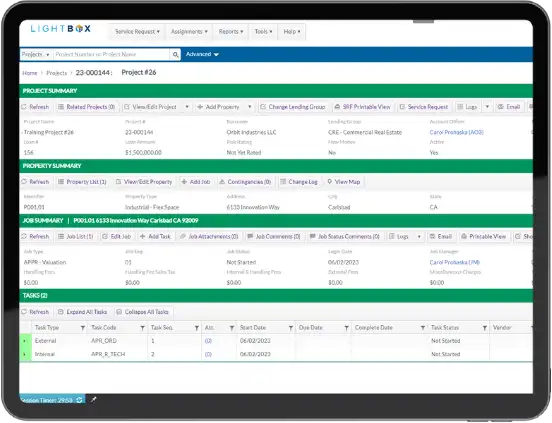

RIMS is the leading Real Estate Information Management system, offering a robust platform for managing your entire loan portfolio. With RIMS, you can:

- Manage Comprehensive Portfolios: Monitor and manage your real estate assets with ease, ensuring that your portfolio remains strong and compliant.

- Use Data to Drive Decisions: Leverage real-time data to make informed decisions that minimize risk and maximize returns.

- Collaborate Better: Improve collaboration across teams with a shared platform that brings together all stakeholders in the lending process.

- Customize Reporting: Generate detailed reports that meet your specific needs, ensuring you have the insights required for effective portfolio management.

LightBox Fundamentals

LightBox Fundamentals: AI-Powered Appraisal Intelligence for Lenders

LightBox Fundamentals transforms static commercial appraisal documents into structured, searchable data delivered instantly via an Excel Add-In. Powered by AI, it eliminates manual data entry, reduces turnaround times, and brings portfolio-level insights to credit, risk, and compliance teams.

- High Accuracy

Powered by a custom AI + Heuristic Engine trained solely on narrative appraisals - Real-Time Excel Integration

For instance access to 80+ key fields and metrics - Zero Setup Needed

Minimal learning curve, realize immediate value

Key Benefits of LightBox Lender Solutions

Accelerate Loan Approvals

Manage all aspects of due diligence in one secure SaaS environment. Plus, connect the core systems, processes and people associated with property due diligence.

Control Lending Risk

Keep close to property-related risk as part of the underwriting process (and over the loan life) through accurate data access, risk analysis and reviews.

Meet Compliance With Ease

Infuse and incorporate lending policies into your workflow to ensure each transaction meets credit, risk, and regulatory standards. LightBox is here to help you comply with FIRREA, vendor management and information security protocols.

Turn Data Into Action

Elevate your business intelligence by capturing data during the lending process to build powerful insights around all aspects of your CRE operations. With our robust reporting, you can gain data metrics to measure staff and appraiser performance—right down to bank metrics on where you’re lending the most and what property types.

Manage Vendors Reliably

Document and manage vendors to cover any aspect of loan due diligence and procurement, such as broker price opinions, site inspections, exterior and interior inspections, commercial evaluations, flood certificates and many more.

Get Dedicated CSM Support

Dedicated customer success and support team to understanding your challenges, providing solutions, and connecting you with other experts at LightBox to dive deeper into your needs and create efficiencies for you.

LightBox Marketplace

The industry’s only marketplace connecting lenders and vendors directly, making it the largest and most powerful platform of its kind. With unmatched scale and reach, we facilitate millions in fees associated with transactions annually.

Our LightBox Marketplace is a vendor-agnostic, digital platform uniquely designed to connect LightBox Lenders with a network of vetted 3rd Party Vendors, providing non-procuring report services (i.e. Evaluations or inspections).

Why Our Lenders Love It: