Digging into a sample of Q3 2023 Bank Earnings

The banking industry has weathered the challenging macroeconomic environment so far. The amount of money set aside to absorb losses from problem loans is at an all-time high; charge-off rates remain historically low; capital and solvency levels are considerably higher than prior other economic downturns; inflation seems to have returned to normal levels; and the regional banking crisis from earlier this year was contained to three institutions.

What are we missing?

Publicly-held banks (whose fiscal year-end is December) reported third-quarter earnings over the last few weeks. We’re still more than a month away from 10-Q SEC filings and quarter-end Call Report data becoming available. In the absence of standard regulatory filings, we can parse through information in earnings presentations and supplemental financial statements as an early indicator of the state of commercial banking.

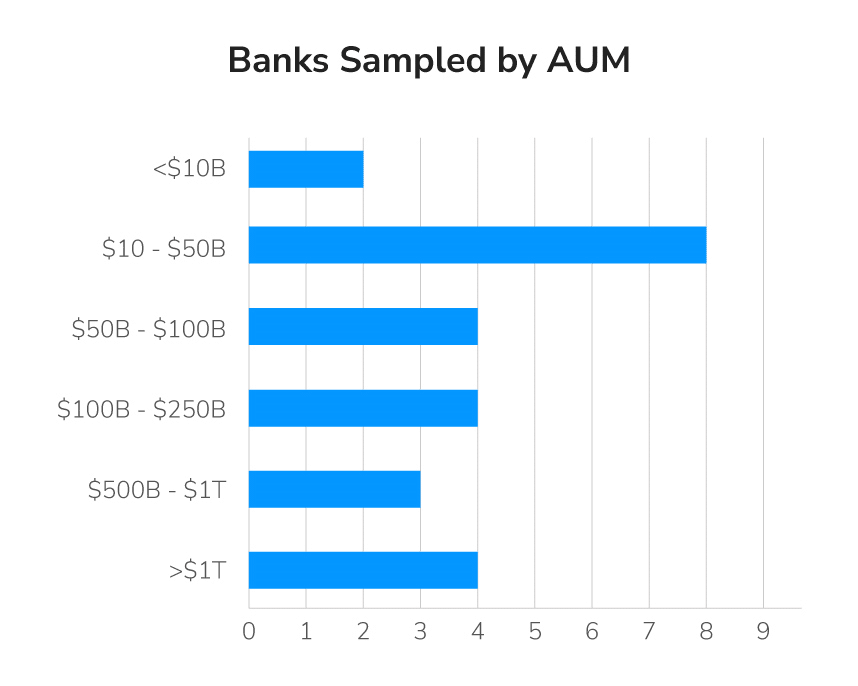

We collected data from a cross-section sample of 25 banks. They include the “Big Four,” the subject of most analysis and industry commentary. They also delve deeper into having a broader industry view – including regional and community bank segments.

Focus on Loan Growth, Deposit Costs, and Net Interest Margin

Thirteen of the 25 institutions reported asset growth during the third quarter. On a year-over-year basis, the average growth rate was 3.1% (2.1% on a balance-weighted basis) – with growth among 16 banks in the sample. Regional banks, Bank OZK and US Bank reported double-digit year-over-year growth at 24.9% and 11.2%, respectively. US Bank closed its acquisition of MUFG Union Bank in the fourth quarter of 2022. None of the banks in the sample reported quarterly or yearly declines in asset growth of 5% or more.

Slightly more than half (13) shrunk their loan portfolio during the third quarter. On a year-over-year basis, total loan growth within the sample was 5%, with only four banks reporting a yearly decline.

Notably, commercial real estate (CRE) loans fueled asset and loan growth with year-over-year average growth of 8.4% (12.4% weighted), with six of our sample banks reporting double-digit CRE loan growth. Only four banks reported a decline in outstanding CRE loans from the third quarter of last year. One outlier’s CRE loan portfolio saw the most significant increase this year’s third quarter, at 6.5%.

Higher deposit costs and additional provisions for credit losses are putting downward pressure on bank profits. The average return on assets (ROA) among the twenty-five banks dropped 15bps to 1.04% during the third quarter, and 16bps from last year. Fifteen banks reported a quarterly decline in ROA, averaging 28bps. Among the eleven banks reporting a quarterly increase in ROA, the average improvement was 11bps.

Net interest margin (NIM) compression continued in the third quarter, with a 6bps decline to 3.09%. Year-over-year, the average NIM dropped 17bps from 3.26%. Seventeen banks reported quarterly margin compression, averaging 10bps. Among the eight banks with margin expansion, their average increase was only 5bps. The most significant downward changes during the third quarter included the community and smaller regional banks. They were also among the highest NIM ratios. For reference, the average industry NIM for small and mid-sized banks during the second quarter (all institutions) was approximately 3.5%-3.6%, compared to 3.0% for banks with more than $250 billion of assets.

Credit Loss Provisions Signal More Uncertainty in CRE

Provisions for expected credit losses are also cutting into bank earnings, primarily driven by uncertainty in commercial real estate markets.

However, on an aggregate quarter-over-quarter basis, the provision expense recorded on bank income statements is down $2.8 billion – indicating that the rate of reserve build has slowed from a quarter ago. Across the board, the level of reserves to total outstanding loans is among the highest for CRE loans relative to other commercial loan portfolios. The third quarter provision expense is up 7.8% compared to a year ago. Industry-wide, the level of reserves for problem loans remains at an all-time high, suggesting that banks have been more proactive this cycle – but also that the prolonged period of near-zero charge-off rates may be ending.

Updates to specific commercial real estate pricing variables influenced reserve builds for two Big Four banks. For one of these banks, provisions for credit losses in the third quarter included a sizeable increase in the allowance primarily for commercial real estate office loans, on top of an increase in commercial real estate net loan charge-offs. For this lender, CRE nonaccrual loans grew as a result of exposure to underperforming office properties.

Charge-off rates remain historically low despite the headlines, particularly for commercial loan portfolios. While the rate has doubled since last year’s third quarter, the sample average is only 0.26%. As a leading indicator of future credit losses, non-performing assets are up 14.1% this quarter and 20.2% from a year ago. Only four banks reported a year-over-year decline in problem loans, further suggesting more loan losses are on the horizon.

For one top-ten bank, allowance for credit losses eclipsed 3% of total CRE loans and quarterly increases in net charge-offs. CRE valuations are also affected by rising interest rates and the changing demand for office properties. Another top-20 bank reported a 52% increase in nonaccrual loans, primarily reflecting an increase in the office segment of commercial real estate. For one regional bank whose CRE loan portfolio is nearly 40% of total loans, there was an increase in net charge-offs year-to-date, compared to net recoveries in the same period a year earlier. Another regional bank reported a quarterly increase in non-performing CRE loans primarily due to two suburban office properties.

Two other regional banks reported their largely suburban exposure in “Work From Home” MSAs with low LTVs and limited near-term maturity risk, as reasons for lower CRE credit risk.

Expect More Challenges Ahead

Despite concerns around commercial real estate and the office sector, bank losses haven’t materialized as widely expected. Our review of earnings calls and presentations suggests prudent underwriting (below 60% loan-to-value ratios) and reduced exposure to large single-tenant properties in central business districts, coupled with maturities due after 2025, have staved off credit losses – for now. It’s nuanced, however. Banks with exposure to older properties in densely populated cities that are reliant on a few large tenants tend to be the ones reporting more significant credit quality concerns. Other sectors aren’t immune, such as those exposed to multifamily oversupply in the Sun Belt region. Another essential factor is the age of property valuations driving reported LTVs, particularly in an environment where transaction volume remains low, and the bid-ask spread is significantly wide.

The Federal Reserve has raised interest rates eleven times in less than eighteen months to slow inflation. While higher rates usually benefit banks because they can charge more for loans, the rapid rate increases made it more expensive to attract and retain deposits. Among the banks in our study, total deposits are down 1.0% since last quarter and 1.8% from a year ago – bringing the average loan-to-deposit liquidity ratio up 3.3% year-over-year. The “Big Four,” who hold nearly $7 trillion in deposits, reported an $89 billion decline in deposits during the third quarter. Conversely, fourteen regional banks saw their total deposits grow by an average of 1.9%, albeit at the expense of profitability. Banks with the highest quarterly deposit growth include Bank OZK, Western Alliance, FifthThird, and Texas Capital. America, and Truist.

Until now, banks paid extremely low rates for deposits for years, including when customers had cash stored from the pandemic. Now, virtually risk-free investments yield 5%, which is tough to compete with. Banks with deposit growth reported pursuing higher-cost customer deposits. In contrast, others have had to change their funding mix, including deposits brokered through a third party or loans from the Federal Reserve or the Federal Home Loan Bank system.

We will continue to monitor the performance of the banking industry and the CRE sector. We expect credit quality to continue the trend of an increasing volume of problem loans and losses but remain cautiously optimistic that an impending crisis may not be as bad as it seems.

FOR MORE INFORMATION

To listen to our on-demand webinar on the current state of the CRE lending market and how lenders are responding to the latest shifting sands, click here.

Want to be invited to the next one? Get in touch with us today.

Chris Henkel

President at Henkel Analytics

With 30 years of banking, finance, and risk analytics experience, Chris has led financial institutions of all sizes with managing financial risks through digital transformation, data science, and business analytics. He has extensive experience in commercial banking (CRE, corporate, middle-market, ABL), credit and financial risk management, advisory services, and B2B sales. Chris brings added leadership value to large, diverse teams utilizing his expertise in financial risk consulting, project design and management, data analysis and interpretation, and financial modeling.

Before his entrepreneurial ventures, Chris most recently served as a Managing Director at Moody’s Analytics, advancing their integrated risk solutions to the commercial real estate (CRE) industry. He led a team of CRE experts and served as the trusted point of contact and advisor for strategic customers across the customer lifecycle–onboarding, adoption, advocacy, and renewal–ensuring they continuously gain business value from Moody’s Analytics products and services.

Chris’ additional activities include authoring articles for trade publications, delivering webinars, speaking at industry conferences, and periodically teaching finance and risk as a guest lecturer at the college and high school levels.

In addition to four years serving our country in the US Navy, Chris holds both an MBA and a BBA in Finance and Accounting from The University of Texas at Dallas, along with a combined four years of post-graduate study in Banking and Financial Support Services at SW Graduate School of Banking (Southern Methodist University) and Data Science and Business Analytics at the University of Texas at Austin.