LightBox aggregates and produces a wide range of data including comprehensive property data from the LightBox RCM platform that powers commercial real estate investment sales for brokers. We’re sharing a high-level overview based on our third-quarter data.

The market has dropped on a quarter-over-quarter basis, but not precipitously, and it isn’t at a standstill, as some media outlets report. Buyer interest is definitely holding firm. We’re providing more than 55 Confidentiality Agreements per listing or per project on average to all our broker partners for deals they bring to market utilizing our technology.

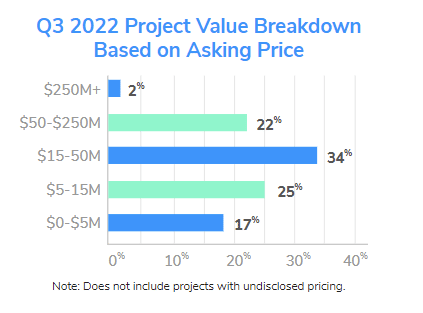

Historically, our sweet spot has been institutional grade properties, with asking prices typically well above $50 million. However, this year we’ve seen steady growth in assets being brought to market that are priced below $15 million, increasing by 20% between Q1 and Q3. Note: Private capital deals are typically in the $5-$15 million range.

Here are some highlights from our third-quarter data:

Deal Velocity and Engagement

Nearly 3,000 total listings, deals, or projects brought to market by brokers using LightBox RCM, with over 150,000 signed Confidentiality Agreements (CAs) during the quarter – that’s an average of 55 CAs per project.

Lightbox RCM maintains a proprietary database of more than 82,000 qualified, vetted and active investors and principals. Access to buyers keeps brokers coming back to the platform, where acquisition professionals can search across a wide range of asset types including office, industrial, retail, land, hospitality, specialty, multifamily and -single-family. We just added data center as a separate asset type based on the changing landscape and market too.

It’s no surprise that multifamily and industrial continue to have the highest velocity of deal volume within the third quarter based on demand. The Fall 2022 Investor Sentiment Report raises concerns about inflation and recession; however, it states that these sectors (industrial and multifamily) will provide a strong hedge against inflation due to the consistent and growing demand for these asset types.

We look forward to sharing the fourth quarter data with you in a few months. In the meantime, please contact us with any questions or feedback.