Dianne Crocker, Research Director, LightBox

The second quarter of 2024 delivered the second consecutive quarter of increases in Phase I environmental site assessment (ESA) activity, a particularly notable development following two quarters of decline in the second half of last year. Anyone expecting the second quarter to bring the first interest rate cut was disappointed, with the Federal Reserve opting instead to keep rates higher for longer, pending more convincing inflation data.

For any environmental consultants struggling to forecast their Phase I ESA business in the second half or benchmark your own Q2 2024 activity against industry benchmarks, here are a few highlights from the latest Snapshot report:

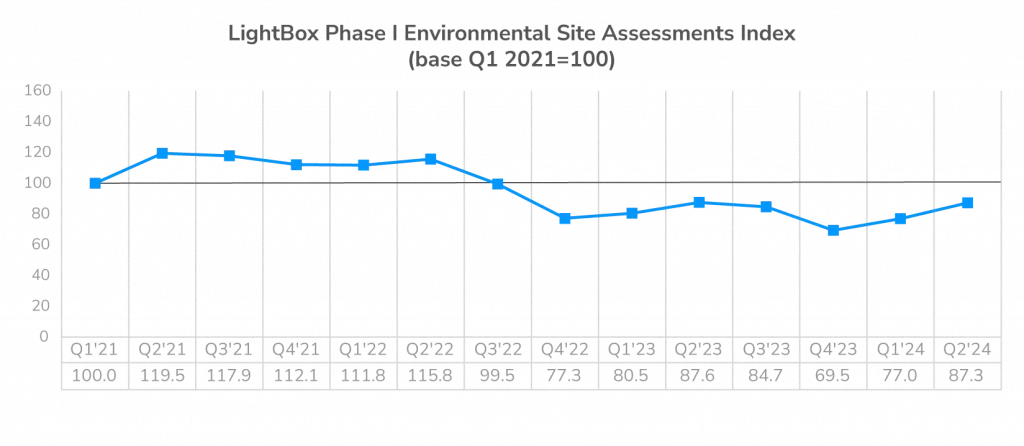

- The LightBox Phase I ESA Activity Index continued its second quarter of increases, reaching 87.3 in Q2, an increase of 10.3 points above Q1.

- U.S. Phase I ESA volume increased 13.3% in Q2 compared to Q1, bringing volume in line with Q2 of last year.

- At the May, June, and July meetings, the Federal Reserve opted to keep interest rates higher for longer.

- Four of the ten largest Phase I ESA markets, accounting for one-quarter of total U.S. volume, outperformed the U.S. Q2 benchmark growth rate of 13%, led by Phoenix with an impressive 22% QoQ growth.

- In April, the US EPA designated two PFAS compounds as hazardous substances under CERCLA, bringing them into the scope of AAI-compliant Phase I ESAs and creating uncertainty as the market adjusts.

NEAR-TERM OUTLOOK: PESSIMISM TRANSITIONS TO CAUTIOUS OPTIMISM FOR 2H 2024

With this Q2 report, LightBox announced the 12 members of its new Environmental Due Diligence Market Advisory Council who share their insights into key market developments each quarter. The industry leaders on the new Advisory Council reported early signs of opportunistic private capital deployment as the market more generally accepts high rates as the “new normal.”

Stephen McNeil, Chief Strategy Officer at Blew & Associates said: “In the near term we see opportunities with agency lending, distressed assets and mezzanine lenders. Distress is surfacing via large influxes of loan volume, and mezzanine lenders are well positioned and picking up steam as investors steadily rely on more subordinate debt.”

Three biggest challenges facing Phase I ESA sector

In the short term, notwithstanding any significant market developments, the LightBox Phase I ESA Activity Index will likely remain relatively flat to modestly increasing through the end of the year and will be sensitive to the timing of a rate cut, any disruption from the election, and whether the momentum of Q2 continues in the second half.

Although market predictions are complicated by the wide range of uncertainties clouding the near-term forecast, it is worth noting that environmental professionals are more optimistic at midyear than they were in Q1 with guarded optimism for more opportunities in Q3 and a potentially strong Q4.

The LightBox CRE Market Snapshot Series, Q2 2024 – Focus on Phase 1 ESA Trends contains more detailed information and metrics on trends in Phase I ESA volume by year, quarter region, metro and for the LightBox25 Index.

For more information about this report series or the data, email Insights@LightBoxRE.com