Alan Hall is Senior Account Executive at LightBox

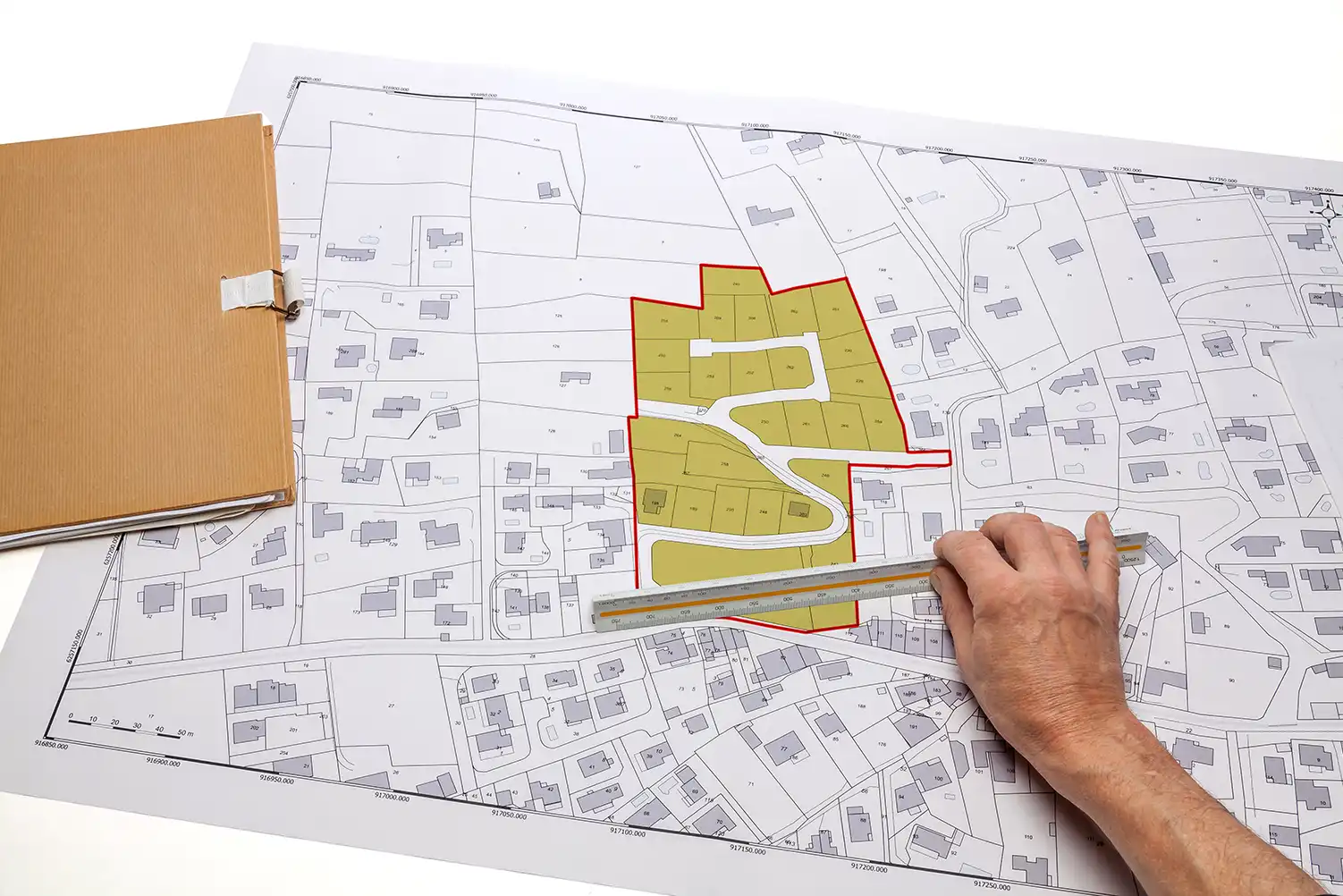

In the intricate world of commercial real estate (CRE), the importance of a comprehensive zoning report cannot be overstated. The zoning report will tell you if your property meets the current standards defined by all of the municipal jurisdictions that govern it. Among the many due diligence steps, obtaining a comprehensive zoning report is critical, providing investors with invaluable insights into a property’s potential pitfalls and opportunities. The primary purpose and function of zoning is to divide a municipality into residential, commercial, and industrial districts or zones that are, for the most part, separate from one another, with the use of property within each district being reasonably uniform. However, in recent years zoning has become increasingly complex with the introduction of overlays, upzoning and frequent rezoning in cities across the country. This dynamic underscores the necessity for comprehensive and up-to-date zoning reports in the CRE sector.

A Cornerstone of Due Diligence

Zoning due diligence has evolved into an indispensable aspect of every real estate transaction. A zoning report meticulously outlines the allowances and restrictions within municipal codes, ensuring that developments and acquisitions comply with legal requirements. For lenders, insurers, and buyers, minimizing risk is paramount, making a thorough zoning report a fundamental step in safeguarding investments.

9 Potential Pitfalls of Inadequate Zoning Reports

- Zoning Designation Oversights: Failure to conduct a thorough zoning report can lead to costly errors in zoning designation. Imagine purchasing a property with plans for development, only to realize later that it’s zoned for a different use entirely, jeopardizing the viability of your investment from the outset.

- Absence of Vital Certificates: Inadequate zoning reports may overlook critical documents such as Certificates of Occupancy (COs), leaving buyers unaware of a property’s legal status. This oversight can result in unexpected delays or regulatory penalties, impacting the transaction’s timeline and financial outcomes.

- Compliance Complications: Inadequate attention to the details of a zoning report exposes property owners to potential compliance challenges. Investing in a property only to discover late in the game that its structures or uses violate zoning codes can necessitate costly retrofits or even demolition, posing significant financial and logistical burdens.

- Navigating Legal Nonconformities: A poor zoning report may fail to identify legal nonconforming features, exposing investors to unforeseen liabilities. From setback encroachments to parking deficiencies, these oversights can escalate into legal headaches and financial woes down the line.

- Underestimating Damage and Reconstruction Implications: Without a detailed zoning report, investors risk underestimating the repercussions of property damage. Failure to assess how deviations from zoning codes could impact reconstruction efforts and can lead to significant financial losses in the event of a catastrophe.

- Unaddressed Code Violations: Incomplete zoning reports may gloss over existing code violations, leaving buyers unaware of looming regulatory issues. Discovering such violations post-purchase could result in costly fines, legal battles, and reputational damage.

- Overlooking Planned Public Projects: Neglecting to consider planned public improvement projects near a property can expose investors to unforeseen disruptions. Infrastructure upgrades or expansions can impact property values and accessibility, affecting investment returns.

- Misguided Pre-Development Assumptions: Proceeding with pre-development plans based on flawed assumptions about a property’s permitted use can lead to wasted time and resources ultimately resulting in a failed project. A zoning report is essential for informed decision-making and risk mitigation in the pre-development phase.

Navigating the Changing Landscape

With zoning codes and regulations evolving rapidly, staying ahead of the curve is crucial for investors and lenders alike. Recent changes in the American Land Title Association (ALTA) survey requirements underscore the importance of timely and comprehensive zoning reports, integrating zoning information seamlessly into due diligence assessments.

The significance of a high-quality zoning report cannot be overstated. It serves as the cornerstone of due diligence, guiding investors through the complexities of regulatory compliance and mitigating potential risks. By prioritizing thorough zoning assessments and enlisting the expertise of seasoned professionals, stakeholders can safeguard their investments and maximize their real estate endeavors.

PZR is accepted by every major Lender and Title Company in the U.S. including Fannie Mae and Freddie Mac. PZR is the nation’s most trusted zoning due diligence company delivering unmatched speed, accuracy, and efficiency, since 1993.