As affordability challenges mount and mortgage rates remain elevated, the U.S. housing market is feeling the strain. May marked a significant slowdown across the board: total housing starts dropped 9.8% to a five-year low, single-family permits declined 2.7%, and new-home sales plunged 13.7%, reaching their slowest pace since October 2024. With buyer traffic dwindling and momentum stalling in key regions, builder sentiment has taken a hit—now at its third-lowest level in a decade. In response, the nation’s largest homebuilders are pivoting, implementing strategic adjustments to safeguard profitability and sustain sales volumes.

KB Home, following a strong earnings beat, revised its full-year outlook and narrowed its average selling price range, citing softer-than-expected spring demand. It wasn’t alone. The top four homebuilders, including DR Horton, Toll Brothers, and Lennar, are reworking their models to match today’s more selective buyers through shorter build cycles, deeper incentives, and more disciplined land strategies.

For commercial real estate investors and developers, these shifts are early signals of what’s next: slower land absorption, repriced expectations, and a more selective approach to development in formerly high-growth markets.

May Housing Starts Hit New Lows

Faced with tighter financing, rising insurance costs, and overbuilding concerns in key metros, developers are pulling back from the apartment sector. Multifamily starts plunged 30.4% in May, falling to their lowest level since November 2024, according to U.S. Census Bureau, while single-family starts held essentially flat, rising just 0.4% as builders tread cautiously into the summer.

Permitting activity also points to deeper cracks forming. Overall building permits fell 2% in May, according to the Census Bureau, with single-family permits dropping 2.7%. This is a clear signal that builders are throttling back on future development plans. While the pullback isn’t as steep as the drop in starts, it suggests the slowdown isn’t a one-month anomaly, but the beginning of a broader pipeline recalibration.

“Permits are the canary in the coal mine delivering a clear message: developers are hitting the brakes,” said Dianne Crocker, research director at LightBox. “We’re seeing signs of a deliberate pullback, especially in mid-rise multifamily, as developers become more cautious and strategic in the face of tighter capital and rising construction costs.”

Adding to the mix of recent data pointing to softer housing market conditions, the NAHB/Wells Fargo Housing Market Index fell to 32 in June, its third-lowest level in 10 years. NAHB Chair Buddy Hughes cited “elevated mortgage rates and economic uncertainty” as top concerns, adding that builders are increasingly relying on incentives to move inventory.

“This is a controlled retreat, not a collapse,” Crocker added. “Builders are recalibrating future starts with more precision as they prioritize margin protection over volume. For CRE, that has implications for land absorption, development pacing, and infrastructure investment in key growth corridors.”

Builder Incentives 2025: Strategies to Preserve Volume & Margins

Homebuilder confidence is deteriorating as price-sensitive consumers pull back, demand remains soft, and mortgage rates stay elevated. According to the NAHB, 37% of builders cut home prices in June, which is the highest share since December 2022. And 62% offered buyer incentives, up from 58% the month prior.

Lennar’s Q2 results showed incentives accounting for 13.3% of home revenue, up sharply from 9.3% a year earlier, and a drop in average selling price to $389,000, a five-year low. Stuart Miller, Lennar’s co-CEO, explained on the earnings call: “While we continue to see softness in the housing market due to affordability challenges and a decline in consumer confidence, we adhered to our strategy of driving starts, sales, and closings in order to build long-term efficiencies in our business.”

Similarly, while KB Home beat Q2 expectations with earnings of $1.50 per share, the homebuilder cut its full-year revenue guidance to $6.3 billion–$6.5 billion from $6.6 billion–$7 billion. Affordability concerns and a muted spring selling season were key drivers. The company also lowered the top end of its expected average selling price, guiding for a range of $480,000 to $490,000, compared with a previous outlook of $480,000 to $495,000.

“Consumers are continuing to demonstrate a lack of confidence about the short-term, which has impacted their home purchase decisions,” said Mezger during the call, citing buyer affordability pressures and broader macroeconomic and geopolitical uncertainty.

In response to these conditions, Mezger stated that KB Home is focusing on operational efficiency by shortening build times and reducing direct construction costs to maintain margin discipline in a slower market.

Fannie Mae’s revised housing market forecast for 2025 reinforces this cautious stance, as the agency recently lowered its 2025 forecast for existing single-family home sales to 4.14 million units, down from 4.24 million. The agency now expects mortgage rates to end the year at 6.5%—a level likely to keep pressure on buyer affordability and suppress sales activity.

For CRE brokers, investors, and developers, this incentive-driven phase of the cycle could create ripple effects across land valuations, housing-adjacent retail, and build-to-rent strategies. “If prices flatten or fall in select metros, appraisals may lag, challenging deal structures,” said Manus Clancy, head of Data Strategy at LightBox. “And if builders prioritize clearing inventory over breaking new ground, landowners may need to reset expectations on absorption timelines heading into 2026.”

Builders Shift Strategy to Stay Ahead as Gross Margins Get Squeezed

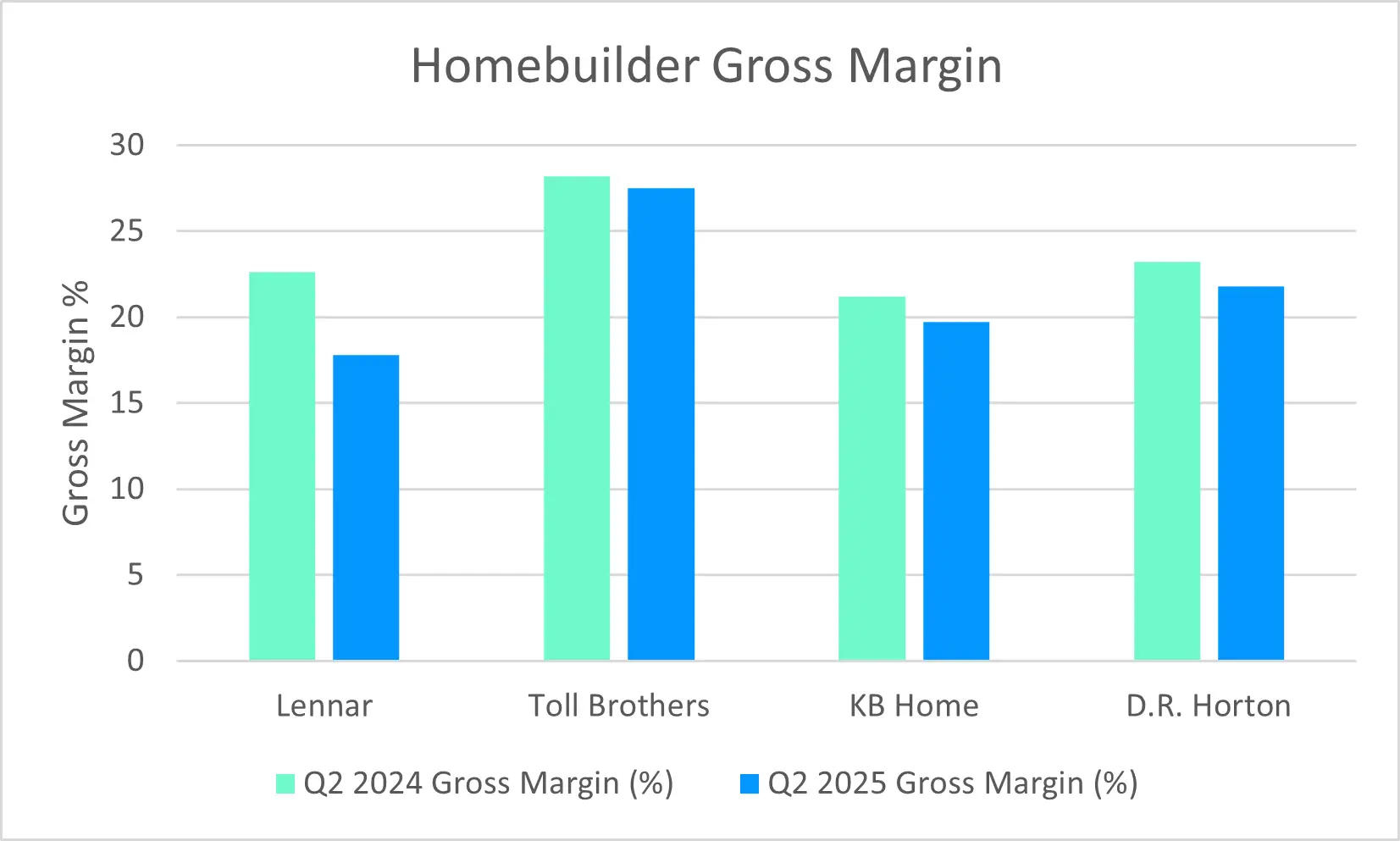

Gross margins are one of the clearest indicators of how homebuilders are responding to affordability pressures and shifting buyer behavior. In Q2 2025, all four major public builders reported year-over-year margin compression signaling that rising incentives and recalibrated pricing strategies are weighing on profitability, even as companies aim to maintain volume.

- Lennar reported a gross margin of 17.8% in Q2 2025, down from 22.6% a year earlier. To offset margin pressures, the company focused on operational efficiency, including a 12% reduction in construction cycle times—down to 132 days—and tighter inventory management. Executives also emphasized Lennar’s asset-light strategy, noting that 98% of homesites are controlled rather than owned, which reduces land risk and increases flexibility. While the company acknowledged that incentives had weighed on profitability, it remained committed to offering buyer concessions in order to maintain affordability and drive volume.

- Toll Brothers maintained the highest margins among its peers, reporting an adjusted gross margin of 27.5% in Q2 2025, only slightly below the 28.2% recorded a year earlier. The company’s performance reflects a combination of product mix optimization, cost control, and operational leverage. By focusing on luxury homes and reducing the share of speculative builds, Toll preserved pricing power while also benefiting from scale. Deliveries rose 10% year over year to 2,899 units, helping the company absorb fixed costs and support margin stability. In its earnings call, Toll noted that “positive mix, strong cost control, and increased leverage” were central to sustaining margins in a challenging environment.

- KB Home posted a Q2 2025 gross margin of 19.7%, down from 21.2% in Q2 2024. The decline was largely driven by price reductions in underperforming markets and expanded use of buyer concessions. CEO Jeffrey Mezger noted that consumer confidence remains fragile, which has affected home purchase decisions across several of its key regions. In response, KB is working to shorten build times and lower direct construction costs to maintain margin discipline. The company also emphasized tighter inventory alignment with current demand trends as a way to reduce future margin pressure.

- D.R. Horton’s gross margin declined to 21.8% in Q2 2025, compared to 23.2% in the prior year. The company leaned on volume to protect profitability, continuing to build at scale despite a 15% drop in net sales orders. It also worked to control direct construction costs and manage overhead, although selling, general, and administrative (SG&A) expenses rose to 8.9% of revenue, up from 7.2% a year earlier. The margin compression reflects both affordability-related sales pressure and a market environment where incentives remain necessary to drive traffic.

Gross margin trends offer a window into how builders are adjusting strategy in a slower, less forgiving market. Investors and developers watching land positions or construction timelines should take note of the operational shifts behind the numbers. Builders are revising deal terms, compressing build cycles, and tightening cost controls to preserve profit in an environment defined by affordability constraints and uneven demand. The variation in margin management, whether through pricing, incentives, or product mix, suggests that risk is not evenly distributed. For developers and CRE stakeholders, this kind of margin discipline may mean fewer speculative land plays and more selectivity in site selection and deal structuring.

Land Absorption in Real Estate: What Slowing Orders Signal

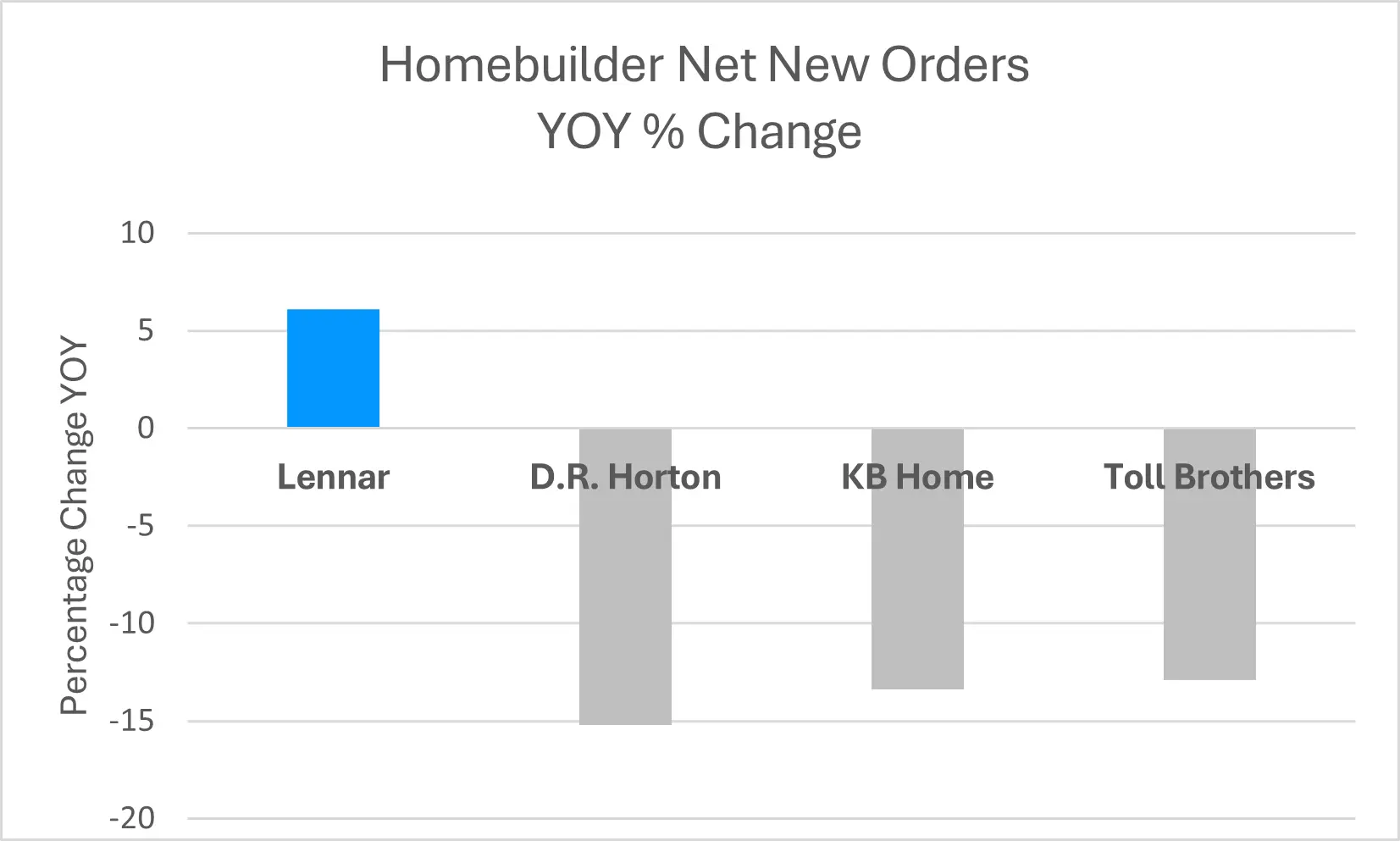

While margins reflect how builders are protecting profitability, net new orders reveal how buyer demand is actually playing out, including where builders are pacing their pipelines. In Q2 2025, order trends varied sharply across the top four homebuilders, most reporting double-digit drops as affordability pressures and consumer uncertainty pushed buyers to the sidelines.

Lennar was the exception. New orders rose 6% year-over-year to 22,601 homes; a sign that aggressive incentives and pricing discipline are paying off. Toll Brothers, meanwhile, saw net contracts fall 13% to 2,650 homes, with softness hitting even its high-income buyers. The company cited “affordability constraints and slower move-up demand,” despite a product line targeting the luxury market. KB Home posted a 13% drop in net orders to 3,460 units. D.R. Horton was hit hardest. Orders dropped 15% to 22,437 homes, a reversal from earlier strength. “Potential homebuyers have been more cautious due to continued affordability constraints and declining consumer confidence,” said Executive Chairman David Auld.

These figures signal that even with strong brand presence and flexible pricing, builders are facing a more hesitant, price-sensitive consumer. For CRE developers and investors, declining orders often serve as early indicators of slower land absorption, delayed takedowns, and more conservative site development timelines. Where sales momentum softens, so does the appetite for new starts which is already translating into reworked pro formas and extended hold periods across many land deals.

2025 Housing Market Forecast: What Builders & CRE Investors Should Expect

Softening starts, dropping gross margins, and the drop in net new orders are reshaping strategic land, development, and underwriting decisions across CRE. Builders are adjusting strategy in formerly hot Sunbelt metros, and the impact is flowing downstream into land markets. In markets like Dallas–Fort Worth, Miami, and Charlotte, where construction has surged in recent years, landlords are now contending with rising vacancy rates and flat-to-declining rents, according to the Census Bureau. In response, some developers are quietly repricing or delaying takedowns of entitled land that no longer supports previous underwriting assumptions.

“The underwriting environment has changed faster than many developers expected,” said Clancy. “Capital is still in the market, but it’s gravitating toward deals with clear fundamentals, up-to-date comps, and well-defined exit strategies.”

At the site development phase, builders are adjusting course as well. In Texas, recent market analysis by Builder’s Daily indicates that some developers are delaying lot takedowns, reworking deal terms, or walking away from previously secured land positions to protect margins and manage capital exposure. That directly affects site development timelines and entitlement decisions, and sends cost ripples through downstream CRE assets like spec-ready pads and utility-backed land.

Where Pressure Becomes Strategy

In the second half of 2025, builders face a delicate balancing act. Builders are holding the line on volume, but it’s coming with new dependencies of deeper incentives, longer timelines, and less certainty around buyer response.

In today’s housing market, the most persistent risk is reliance on outdated assumptions, Clancy noted. “Land values, pro forma timelines, and entitlement strategies still anchored in 2022-era pricing or velocity no longer reflect current market conditions,” he said. “The difference between profit and loss may come down to how recently your model was updated.”

For more insights on homebuilder data and trends, subscribe to Insights and the CRE Weekly Digest Podcast.