Assemblages have become a pivotal strategy in the commercial real estate (CRE) sector, offering a path to maximize land use and investment returns. This process, which involves merging adjacent parcels of land to create a larger, more valuable property, either for better marketability for sale or for development, is gaining traction among developers, brokers, and investors. By identifying the highest and best use of combined parcels, assemblages can significantly enhance the value and potential of the property. But why are assemblages so significant, and how are they shaping the CRE landscape?

The Mechanics and Motivation Behind Assemblages

Assemblages are not just about increasing the size of a property. They are a strategic move designed to unlock higher development potential, elevate property values, and provide more attractive options for buyers and tenants. By combining smaller parcels, developers can undertake larger, more impactful projects that would be impossible on individual lots. This often results in higher density developments, such as multi-story office buildings, expansive retail centers, or significant industrial facilities, which can yield greater returns on investment.

Industrial Growth Driving Assemblages

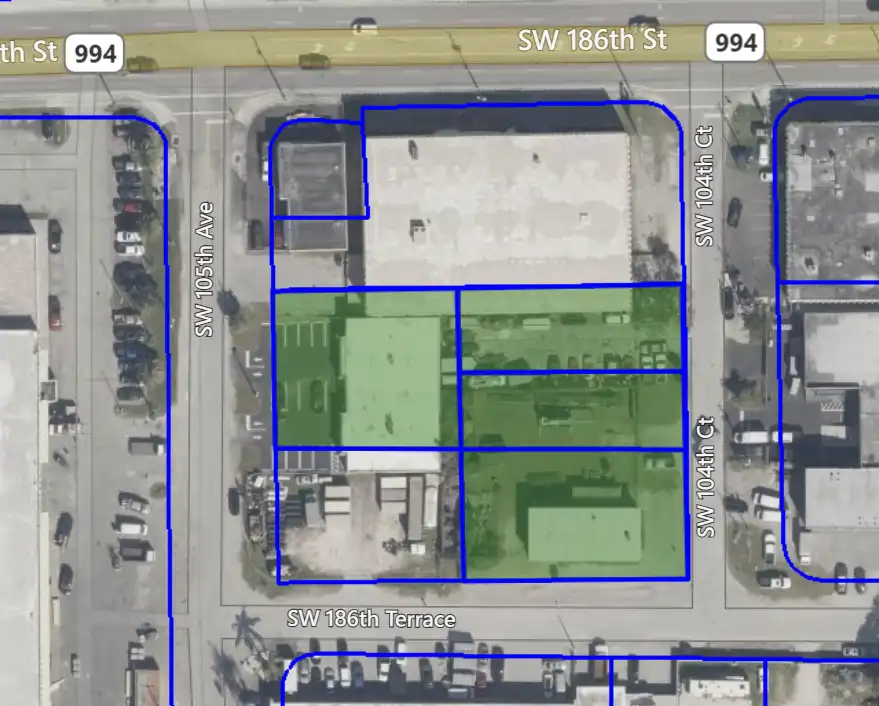

A notable trend is the rise in industrial assemblages, particularly in areas with growing logistics and distribution needs. Lee & Associates South Florida’s recent industrial assemblage transaction in South Miami-Dade County exemplifies this. This assemblage comprised three transactions over a nine-month period totaling 15,740 square feet (a 6,140 square-foot warehouse, a 2,100-square-foot warehouse on two parcels, and a vacant 7,500-square-foot lot), enhancing the industrial capacity of the region and significantly boosting property values.

In another industrial assemblage, Woodhill Real Estate purchased six warehouses, spanning 5.9 acres and nearly 159,000 square feet, in Hialeah—a Miami suburb. No specifics have been released yet as to what is planned for this property, although the acquisition is primarily seen as a strategic investment to enhance the industrial capacity of the area, which aligns with the growing logistics and distribution needs driven by e-commerce and supply chain demands. The warehouses are expected to continue serving industrial purposes, which could include logistics and distribution centers

Notably, adjacent to this is the Amelia District, a planned mixed-use project featuring 30 apartment units and two commercial units totaling 17,000 square feet, along with retail and restaurant buildings. The Amelia District aims to revitalize the area with the Amelia Live project, offering restaurants, bars, shops, and an art gallery.

Transforming Neighborhoods: The Role of Assemblages in Urban Areas

In urban areas, assemblages are playing a critical role in revitalizing neighborhoods and supporting mixed-use developments. Capital Square’s assemblage in Richmond, VA will encompass a 2.18-acre property featuring 220 traditional apartment units and 100 furnished luxury apartment hotel rooms. This project involved acquiring and merging multiple properties (two restaurants, a painting and carpentry business, and a church) to pave the way for this large-scale mixed-use development to combine residential, retail, and office spaces, transforming the area into a vibrant urban hub and making it more appealing to both businesses and residents.

Strategic Redevelopment in High-Growth Areas

Assemblages are also popping up in high-growth areas where land is scarce, and the demand for comprehensive redevelopment is high. The six-acre site in Austin, TX is a powerful example of this. The project assembled well-known properties like the iconic Ego’s Bar and South Congress Square Apartments along with two commercial buildings and a mental health facility. The new development will include 800 residential units, a 225-room hotel, 200,000 square feet of office space, 90,000 square feet of retail, 30,000 square feet for restaurants and a grocery store. By strategically combining parcels, the assemblage maximizes land use and aims to rejuvenate a key area in the city, attracting businesses and residents alike.

Insights and Future Outlook

The rise in assemblage transactions reflects a broader trend towards maximizing urban land use and meeting the evolving demands of modern developments. For CRE investors and developers, assemblages offer a pathway to create more substantial, profitable projects in increasingly competitive markets. As urban centers continue to grow and land availability diminishes, the strategic importance of assemblages is likely to increase.

Moreover, the success of recent assemblage deals indicates a robust market interest in larger, mixed-use developments that can support diverse economic activities. This trend not only enhances property values but also contributes to urban revitalization, making cities more vibrant and livable.