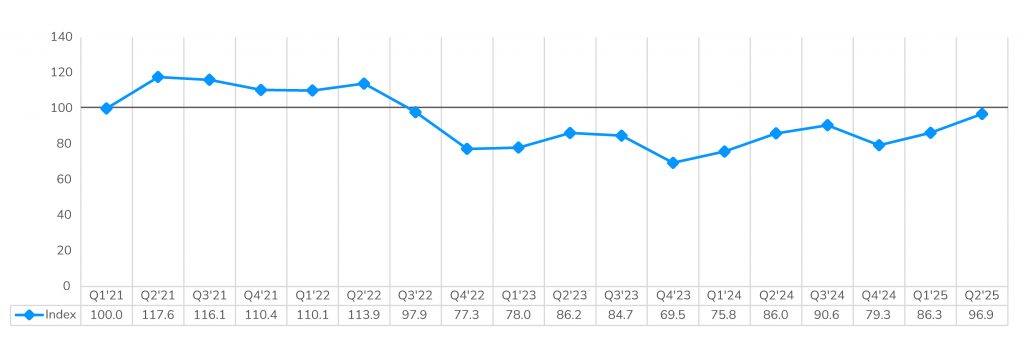

The LightBox Phase I ESA Activity Index climbed to 96.9, up 12% from Q1 and 13% year over year, reaching its highest level since early 2023. This is a noteworthy achievement for ESA activity given the disruption triggered by the onset of the tariff wars in April.

The 10-point month-over-month gain puts the Index at its highest level since Q3 2022, signaling that despite persistent headwinds, demand for environmental due diligence is accelerating. While debt capital is more accessible than late last year, lenders and investors remain cautious, with underwriting standards tight and spreads still elevated. Tariff pressures and stalled interest rate movement continue to inject uncertainty into the CRE environment. Yet, Phase I ESA activity continues to climb, driven by investors eager to place capital, a growing demand for the refinancing of maturing loans, M&A activity, and brownfields redevelopment.

Other Key Q2 2025 Phase I ESA Developments:

- Houston led metro-level Phase I ESA growth in the first half of 2025, with demand up 42% year over year, followed by Raleigh (38%), and Oklahoma City (30%).

- LightBox Market Advisory Council members rated the Phase I ESA market at 63 out of 100, down from 70 last quarter, reflecting rising uncertainty.

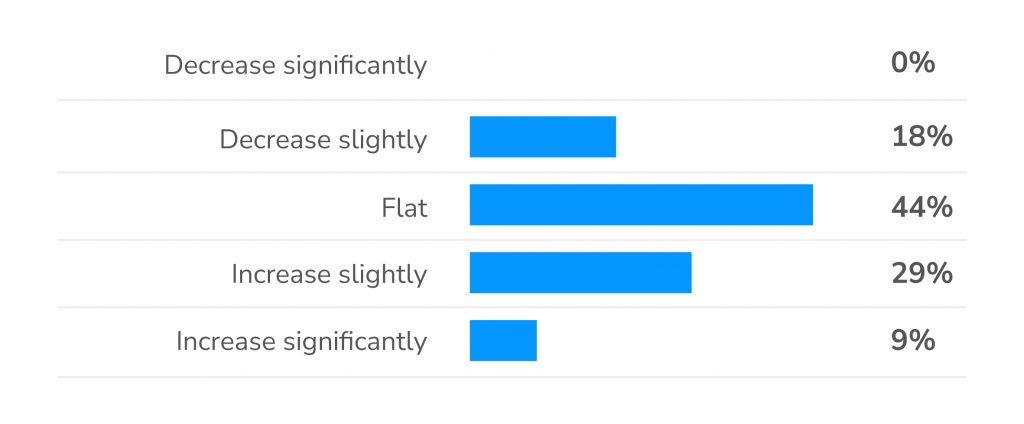

- 9% of environmental consultants responding to the LightBox Mid-Year CRE Sentiment Survey expect CRE deal activity in the 2nd half of 2025 to “increase significantly” and another 29% are forecasting a “slight increase.”

LightBox Phase I ESA Activity Index (base Q1 2021=100)

Whether this growth continues into Q3 will depend on clearer signals from the Fed, capital markets, and trade policy, but for now, the Phase I ESA market continued its second consecutive quarter of growth.

Phase I ESA Sentiment Reading Declines to 63, a 7-Point Drop from Q1

The new 2025-2026 LightBox Environmental Due Diligence Market Advisory Council (see final page of report for members) reported moderate-to-stable Phase I ESA market conditions in Q2 2025, although growing uncertainty began to weigh on sentiment. On a scale of 1 (worsening) to 100 (improving), the Council assigned an average market score of 63, down from 70 in Q1, a sign of increased caution following the tariff-driven volatility that emerged during the quarter.

The moderate drop in the reading keeps the reading in growth territory, suggesting a shift to a more cautious stance as the Phase I ESA market adjusts to mixed signals from capital market and growing concerns over trade policy, inflation pressures, and a stalled interest rate environment.

As clarity develops around federal policy and interest rate direction in the second half of the year, the Q3 sentiment reading will provide an interesting view of how market perceptions are changing in the second half of 2025.

Phase I ESA Forecast: Measured Optimism in an Uncertain Market

If 2025 has proven anything, it’s that uncertainty is the only constant. Concerns about interest rates, tariffs, and economic stability remain front and center. Yet, despite these headwinds, the Phase I ESA market continues to build momentum. The June LightBox CRE Activity Index posted its strongest reading of the year, reflecting consistent deal flow even as underwriting timelines lengthen and project execution becomes more complex. The Phase I ESA Index rose in both Q1 and Q2, and, barring an unexpected shock, Q3 appears poised for further growth.

Environmental consultants report navigating a volatile mix of capital market fluctuations, staffing unpredictability, and inconsistent project pipelines. Still, sentiment remains largely steady-to-optimistic. In LightBox’s Mid-Year CRE Sentiment Survey, 82% of respondents expect flat or increasing deal volume in the second half of 2025, a clear sign of a market soldiering on.

“The process of closing a transaction or loan on most of our transactional ESA business can be 2-3 months, on average, so not knowing what the economy will look like between the start of the transaction and its closing is causing hesitation for those who are not needing to transact.”

– Jeff Coyne, Senior Vice President, GRS Group/NV5

Expectations for CRE Deal Activity in H2 vs. H1 2025

For full insights into the latest trends shaping the environmental due diligence sector and what’s ahead for Phase I ESA activity in 2025, read the full report.

The LightBox CRE Market Snapshot Series, Q2 2025 – Focus on Phase I ESA Trends contains more detailed information and metrics on trends in Phase I ESA volume by year, quarter region, metro and for the LightBox25 Index.

For more information about this report series or the data, email Insights@lightboxRE.com