As the market turns the page on the first half of 2024, the LightBox CRE Activity Index saw its fourth consecutive month of increases from May to June. The recent improvements are an encouraging sign that momentum in functions like environmental due diligence, appraisals and property listings that support transactions is building even in the absence of interest rate cuts by the Federal Reserve.

Our latest monthly commentary highlights meaningful evidence that the CRE market is moving forward slowly and cautiously in closing deals where the numbers make sense, and in some cases, at appreciated values relative to prior sale prices. Although the market faces concerning headwinds in the second half, the latest Index suggests that tailwinds like favorable fundamentals are boosting activity as assets move into play.

Slight Upticks in Activity at Mid-Year

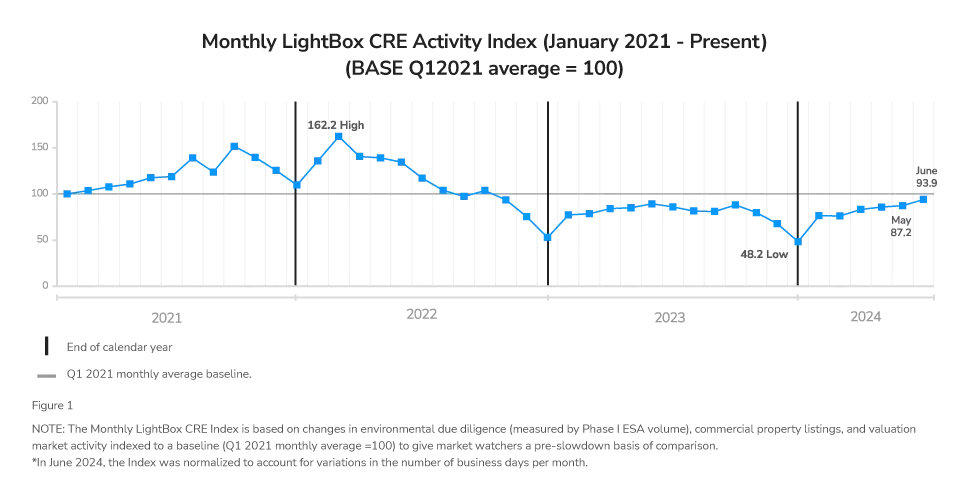

June’s aggregate Index, coming in at 93.9, is an uptick over May’s 87.2 and well above December’s three-year low water mark of 48.2.* It’s important to note that the index is normalized to account for differences in the number of business days in any given month so despite being a relatively short month (20 business days versus 22 in May 2024 and June 2023) June’s Activity Index improved month-over-month and compared to one year ago when the reading was 85.9.

With Rate Cuts on Hold, Market Proceeds with Caution

Both the Index and anecdotal evidence support the notion that even with interest rate cuts effectively on hold pending more definitive inflation data, the CRE market is moving forward slowly and cautiously. In many respects, the impression driven by the dire news headlines doesn’t match the current situation. For one, the wall of loan maturities has not translated into massive defaults thus far. The expected divestiture of loans by banks is underway with new buyers willing to step up to acquire loans in spite of the headline risk.

In office and some multifamily, the turnover of assets has begun, a trend that could result in a significant transfer of ownership in some metros like New York City, Chicago, and San Francisco. Portfolios of loans and properties are changing hands as banks and investment funds attempt to limit their exposure to CRE risk and increase liquidity. Distressed asset transactions continue to filter through the market, some at significant losses, particularly with downtown office assets, but loan modifications are up, meaning fewer distressed assets are coming to market.

Active developers are moving forward with plans to repurpose struggling properties like Class B and C office or outdated shopping centers into new, more desirable uses like open air retail or live-work-play developments. If past downturns are any indication, market participants will soon sense that prices are approaching bottom and the time to shop around for deals has arrived, even in the absence of interest rate cuts.

“With every passing month, we’re seeing evidence that intrepid CRE professionals are wading into the waters of dealmaking. While the market is still below the early 2021 Index baseline, these recent signs are encouraging as the industry readies itself for the transfer of assets that typically happens after an economic downturn,” observed Manus Clancy, LightBox Head of Data Strategy.

“Steady On” Mode as Market Moves into Second Half

Despite four months of steady, albeit modest, improvements in CRE transaction activity, the next six months will likely still bring headwinds.

Our near-term forecast reflects the mix of headwinds and tailwinds facing CRE, starting with the uncertainty of the Fed’s timing in cutting interest rates. The Federal Reserve meeting at the end of July could provide more clarity on the future path of rate cuts, especially if inflation numbers continue to move in the right direction. The first interest rate cut, whether it happens in the second half of this year or early 2025, will bring a psychological impact and likely deliver a boost to investment and lending activity. Until then, any buyers reliant on borrowed capital will face challenges. Moreover, a divisive Presidential election is ahead, so the forecast needs to account for a likely pause in late Q3 and early Q4, characteristic of any election year.

Tailwinds Fueling Modest Movement

The U.S. economy continues to expand according to Gross Domestic Product Q1 data (annualized 1.4% growth). The private equity amassed with U.S. CRE in its crosshairs continues to grow impatient. Meanwhile, the gradual increase in transactions is bringing pricing into sharper focus, a clarity that was largely absent for much of last year. As more deals close, some at appreciated values relative to the previous sale, investors will get the sense that it’s time to shop around for deals. While there are differences by asset class and geography, generally favorable fundamentals are also boosting an otherwise uncertain forecast.

“Among the more encouraging signs recently has been the uptick in big portfolio sales, the fact that there are multiple bidders for many distressed office sales, and that property sales are taking place across all segments of the market. We talked extensively about this on the recent CRE Weekly Digest podcast – that buyers are no longer waiting for another leg down in property values. They are putting cash to work which is a great sign,” Clancy said.

The latest LightBox CRE Activity Index suggests that the tailwinds are fueling modest improvements as assets move into play, either due to forced transactions or because market players are willingly putting properties on the selling block as the bid-ask spread narrows. If last July is any indication, the July 2024 CRE Activity Index could come in slightly below June’s due to a characteristic summer slowdown, but this year is anything but typical.

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.