A Mid-Cap Surge Keeps Markets in Motion

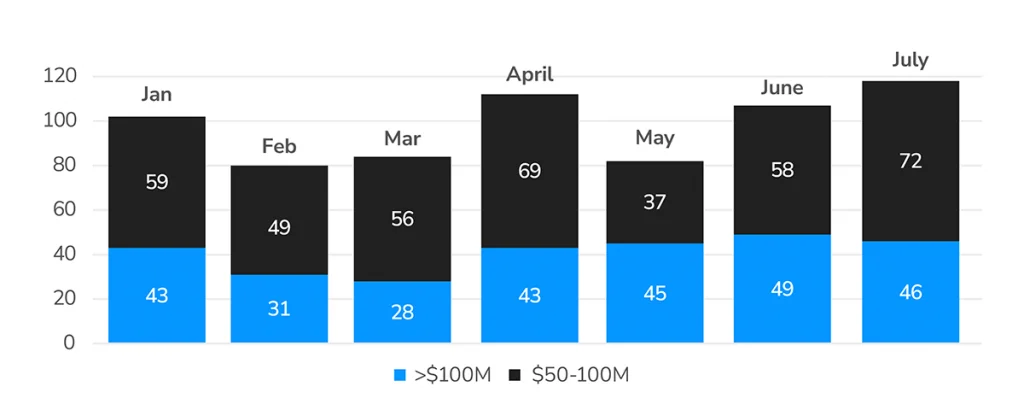

July marked another active month for commercial real estate transactions, with total deal volume reaching its highest level of 2025. According to the LightBox Transaction Tracker, overall volume climbed 10% over June, even as macro headwinds like inflation and weak jobs data loom in the background.

Major Commercial Real Estate Deals (YTD 2025)

July saw 72 mid-cap ($50–$100M) deals, a sharp jump from 58 in June, while nine-figure transactions eased slightly to 46. This shift highlights investor discipline in the current environment. Capital is still flowing, but buyers are targeting deal sizes where pricing is clearer, underwriting is easier to defend, and access to financing is less constrained.

“There’s still meaningful liquidity in the market, but it’s moving toward asset profiles that feel more manageable in today’s interest rate and risk environment.”

– Manus Clancy, Head of Data Strategy, LightBox

Mid-Cap Multifamily Trades Double, Defining July CRE Activity

- Multifamily dominated mid-cap activity with 38 trades, more than double June’s volume, aligning with strong renter demand and refinance-driven sales.

- Hotels reemerged with 7 transactions after being absent in June, reflecting stabilized travel markets and recalibrated pricing.

- Industrial held steady while office remained uneven with only 5 trades at each tier.

- Niche sectors like assisted living, student housing, and self storage also registered selective activity reflecting steady investor interest in sectors driven by life-stage needs and long-term structural trends.

This is just a snapshot of the trends shaping CRE deal flow. The full July Major Transactions Report includes sector-level details, top buyer rankings, and forward-looking analysis from our data team.

Access the Report Now: