The second quarter delivered continued improvement in the volume of commercial properties being brought to market as the transaction velocity that emerged in Q1 2024 continued. Commercial property listings brought to market on the LightBox RCM platform increased 14% quarter over quarter, and a more moderate 3% year-over-year as the market adjusted to the pause on interest rate cuts.

In a particularly encouraging development, all four of the major asset classes (multifamily, retail, industrial, and office) experienced quarter-over-quarter increases in listings volume, ranging from 2% to 34%. Year-to-date property listings, however, are little changed from the first half of 2023, although the market is different in several significant respects.

These results are consistent with the latest LightBox CRE Activity Index, which increased in June for the fourth consecutive month. This round of dealmaking early in the recovery, particularly large deals closed by such big-name investors as Blackstone, KKR, the Carlyle Group and others, will likely entice buyers in many sectors and geographies.

For brokers and investors eager to benchmark their own Q2 2024 activity against industry benchmarks, our latest CRE Market Snapshot for capital markets and investment trends highlights the latest insights and forecasts.

Key Highlights:

- The LightBox CRE Property Listings Index rose 14 points to 113.8 in Q2 2024 from 99.8 in Q1 and 110.4 one year ago.

- As sellers exhibit a greater willingness to move assets into play, the total volume of property listings increased 14% quarter over quarter and a more modest 3% over last year.

- The average number of non-disclosure agreements (NDAs) per listing, a key measure of demand for property investment, rose to 105 in Q2, bringing it in line with 2023’s annual average.

- Retail saw substantial growth in transaction volume, as well as investor interest, with listings volume up nearly 19% quarter–over quarter and 21% year over year. (Average NDAs of 113 in Q2 2024 marked a historical high since 2022).

- LightBox RCM listings priced below $20 million accounted for 57% of overall deal volume in the second quarter. Multifamily and retail accounted for approximately half of these deals.

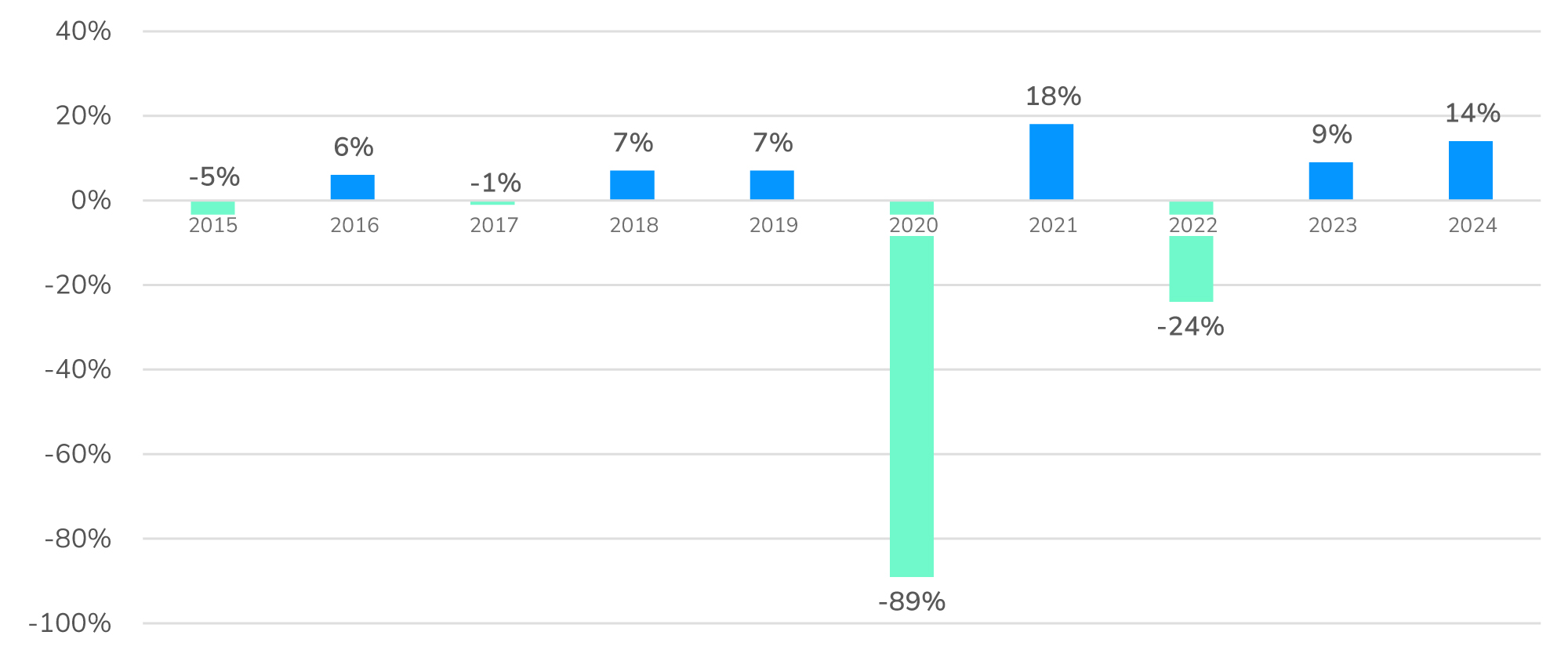

Highest QoQ Uptick Seen in Three Years

Historical Q2 vs. Q1 Benchmarks: LightBox RCM Property Listing Volume (2015-2024)

Despite still-high rates, the rising strength of the Index is a promising early indicator that sellers, either through forced sales, efforts to divest assets, or a recognition that prices are approaching bottom, are gradually returning to the market. The Q2 increase in commercial property listings landed the Index 3.4 points above where it was last year. In the past two years, Q3 delivered a modest downturn below Q2 numbers. With the latest inflation reports igniting speculation that the Federal Reserve could be close to the first rate cut of the year, it will be interesting to see how this year’s third quarter plays out. The rise in buying activity that gained steam in Q2 as investors, especially those who amassed dry powder during the downturn, is likely to continue as other investors follow their lead.

“After two significant downturns in 2020 and 2022, attributable to COVID and record-high interest rates, it is encouraging to see the increase in property listings in Q2 over Q1. While this is a relatively modest uptick considering the double-digit declines we’ve seen in recent years, it’s worth noting that it’s the highest quarter over quarter uptick that we’ve seen in three years.”

– Tina Lichens, General Manager, Capital Markets, LightBox

A Look to the Second Half of 2024

Four months of steady, albeit modest, improvements in CRE transaction activity are fueling a cautiously optimistic forecast for the second half, but one that is not without headwinds, starting with the uncertainty of the Fed’s timing in cutting interest rates. The July FOMC meeting could provide more clarity on the future path of rate cuts, especially if inflation numbers continue to move in the right direction. The first interest rate cut, whenever it finally occurs, will bring a psychological impact and likely deliver a boost to investment and lending activity. Until then, any buyers reliant on borrowed capital will face challenges. Moreover, a divisive presidential election is ahead, so the forecast needs to account for a likely pause in late Q3 and early Q4, characteristic of any election year.

The gradual increase in transactions serves to bring pricing into sharper focus, a clarity that was largely absent for much of last year. As more deals close, some at appreciated values relative to the previous sale, investors will get the sense that the window of opportunity is open. With liquidity slowly returning, the story of the second half of 2024 becomes one of opportunity and how fast and how aggressively those with capital will pursue investments.

The forecast for the Property Listings Index is somewhat dependent on the timing of the first rate cut, but reflects the momentum of late Q1 and Q2, driven by capital chasing new emerging opportunities and an expanding pool of buyers. Additionally, positive underlying property fundamentals are expected to support the case for continued growth over the next two quarters. The transactions that closed in Q2 are a sign that the period of opportunity has arrived and if the past is any indication, those with the financing to take advantage of them will move quickly.

This analysis is part of the LightBox Quarterly CRE Market Snapshot Series, which provides insight into activities that support commercial property dealmaking. The data presented in the Focus on Capital Markets and Investments are derived from the activities of the LightBox RCM platform and used to calculate the LightBox Commercial Property Listings Index. LightBox RCM is the industry’s leading go-to-market listing platform that powers investment sales, as well as debt and equity deals. As a trusted CRE technology solution, LightBox RCM offers a global marketplace for buying and selling CRE and increases the speed, exposure, and security of deals through one streamlined online platform. Brokers can leverage integrated property marketing tools, transaction management and business intelligence.

For more information about this report series or the data, email Insights@LightBoxRE.com