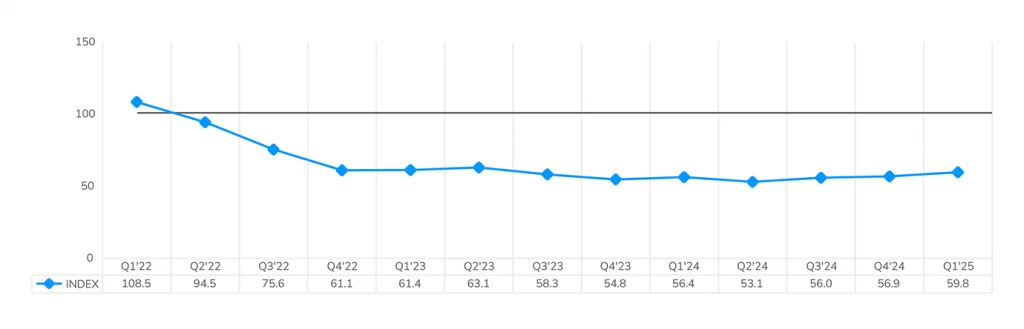

The LightBox Appraisal Index rose to 59.8 in Q1 2025, marking a 5% quarter-over-quarter increase and signaling renewed momentum in CRE activity. The uptick was fueled by a rebound in refinancing demand tied to maturing loans and a cautious reentry by big banks into the lending space. Despite intensifying volatility in federal policy and the bond market, appraisal volume climbed 10% on LightBox platforms compared to Q4, reflecting a slow but steady thaw in capital flows.

Key Q1 2025 Developments from the Appraisal Snapshot Report:

- Total appraisal award volume, measured in dollar terms, was $56.8 million in Q1, a 15% year-over-year and 10% quarter-over-quarter jump.

- The average appraisal fee per lender project reached $3,402 in Q1, marking a 10% increase from the prior year and a 3% uptick from Q4 2024.

- Amid heightened market competition, the average lender appraisal turnaround time shortened to 13.5 business days—2 days faster than the previous quarter.

- Retail took the top spot in appraisal projects by asset class, accounting for 22% of all activity inQ1, with industrial and multifamily rounding out the top three.

Q1 Appraisal Index Highest Level Since Q2 2023

January’s appraisal awards surged 33% over a slower-than-usual December, due to a combination of typical seasonal slowness as well as market volatility, followed by more modest—but still strong—13% growth in February over January.

The rise reflects a pickup in selective CRE lending activity, particularly among large institutions that spent much of 2024 cleaning their balance sheets of nonperforming loans and extending loan maturities in anticipation of lower interest rates down the road. It’s worth noting that Q1’s uptick in overall appraisal awards brought the Index closer to levels last seen in Q2 2023, when it peaked at 63.1—just before elevated interest rates and a cooling market triggered a CRE lending slowdown.

The winds of March ushered in new tariff policies and historic swings in the equities market and 10-year Treasury yields and a 12% decline in month-over-month appraisal awards. Despite a 7% quarter-over-quarter increase in appraisal awards and a 4% year-over-year gain, March’s figures suggest a potential deceleration in growth momentum. While activity continues to rise, the pace of that growth has moderated month-over-month, which may indicate emerging caution in the market following a robust start to 2025.

LightBox Appraisal Index (Base Q1 2021=100)

Moderate Near-Term Growth, Pending More Policy Clarity

Barring an unexpected market upset, the expectation for 2025 is for a moderate growth path for investment and lending as the market sees more opportunities than in 2024. The speed with which those with access to debt or equity capital reinvigorate investment activity will play a significant role in how quickly dealmaking ramps up in coming quarters, but it seems unlikely that the market will bounce back as quickly as it did post-COVID.

For appraisers, these dynamics will necessitate close monitoring of shifting capitalization rates, evolving lender underwriting standards, and market sector bifurcation. Property valuations in 2025 will reflect the wide geographic and sector-specific differentiation and will require a nuanced approach to risk assessment and forecasting.

Although the Q1 LightBox Appraisal Index was strong both year-over-year and quarter-over-quarter, several LightBox Market Advisory Council members noted that even though liquidity has been improving this year and transactions flow recovering, in the first few weeks of Q2, some lenders and investors have started to pull back from making decisions given so much uncertainty on the federal policy front, particularly with tariffs. Greater policy clarity is likely to emerge by the second quarter, providing a more defined framework that will influence investment strategies and market dynamics through the remainder of 2025.

Q1’s momentum may cool slightly in the months ahead, and all eyes are on where the Appraisal Index heads next as trade policy shifts, inflation pressures, and market uncertainty continue to weigh on sentiment. The full report breaks down the detailed Q1 appraisal data behind the Index and includes a forward-looking forecast that offers a window into how CRE could perform in a landscape shaped by evolving risks and investor caution.

The LightBox CRE Market Snapshot Series, Q1 2025—Focus on Lender-Driven Appraisal Trends—presents data from more than 1,200 banks and credit unions across the United States and reflects industry benchmarks specific to lender-driven commercial property appraisal activity. The data are derived from LightBox applications Collateral360 and RIMS, which are used by financial institutions to manage and procure appraisals in support of property lending activity. The LightBox CRE Activity Index combines appraisal activity with environmental site assessments from LightBox EDR and property listings in LightBox RCM to create a composite of CRE transaction activity.

For more information about this report series or the data, email Insights@LightBoxRE.com