In 2025, builder-developers are confronting tighter margins, higher acquisition stakes, and new constraints in site feasibility. Construction input costs are rising across the board, not only due to steel and copper tariffs, but also from lumber-specific policy shifts. On August 8, the U.S. raised tariffs on Canadian softwood lumber to 35%, pushing lumber prices up 15% year-over-year. Material prices rose more than 5% year-over-year by midyear, and the National Association of Home Builders estimates that new tariffs alone could add $7,500–$10,000 to the cost of a single-family home.

At the same time, land pricing remains elevated and power availability is becoming a key filter for site selection, especially for energy-intensive asset classes like data centers and advanced manufacturing. In those sectors, viability often hinges on factors like proximity to substations, transformer capacity, and grid readiness, which can add years to project timelines if overlooked.

For developers planning residential, multifamily, industrial, or mixed-use projects, success increasingly hinges on their ability to qualify land early. That means going beyond acreage and location. Teams need to assess zoning feasibility, environmental risk, ownership structure, and infrastructure capacity, all before reaching out to a seller.

What’s Holding Site Selection Back in 2025

Every builder-developer is asking the same questions when evaluating land today:

- Can I build what I want to build here?

- Will this project pencil under current costs and constraints?

- Who actually owns this site and how do I reach them before my competitors do?

- How can I validate and move on opportunities without burning weeks of staff time?

These questions cut across asset types. Residential builders are navigating tighter zoning overlays and extended entitlement timelines. Industrial developers are balancing speed-to-market with utility capacity and environmental hurdles. Retail and mixed-use teams are working to align land selection with demand and community support. And all of them are making high-stakes decisions in a compressed timeframe.

What makes this harder is the fragmentation of critical information. Zoning data lives in PDFs or buried in municipal GIS. Ownership records are often cloaked in LLCs or trusts. Environmental constraints like flood risk or brownfields require consultant input. And deal teams are still toggling between static maps, third-party reports, and siloed systems to get a basic read on a site’s viability.

“Developers are moving faster than ever,” said Valerie Ammouri, senior vice president at LightBox. “But the real differentiator is how early they’re validating zoning, risk, and ownership. That’s where deals are won or lost.”

How Developers Are Streamlining the Front End of Land Acquisition

In today’s environment, winning deals doesn’t come from chasing everything, but instead from filtering smarter, earlier, and faster. Builder-developers are investing in tools that cut across disciplines and give acquisition, entitlement, and finance teams a shared view of land potential before boots hit the ground.

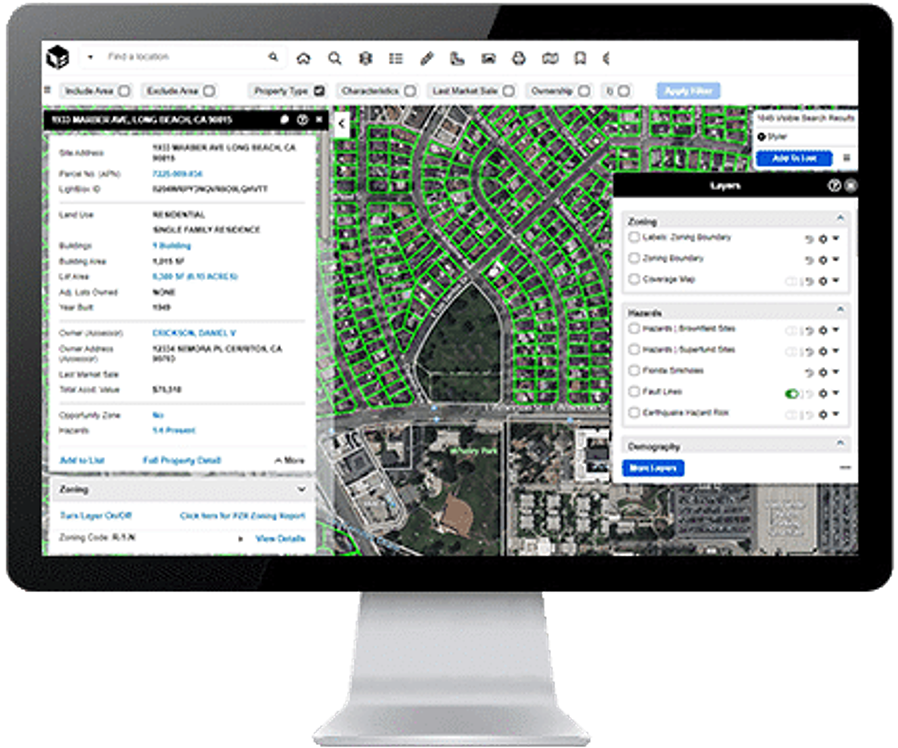

That’s where smarter tools change the equation. LightBox Vision was built to streamline early-stage diligence to give developers the ability to screen sites based on zoning, risk, infrastructure context, and market signals, and then move straight into ownership discovery without breaking stride.

Smarter Site Selection from the Start

LightBox Vision brings together the most comprehensive parcel data, zoning details, environmental risk layers, and market analytics so builders and developers can screen entire metros, filter by development criteria, and zero in on qualified sites in minutes.

Why builders and developers rely on LightBox Vision:

- Parcel Intelligence: Instantly access ownership, zoning, land use, size, sales history, and more across millions of parcels.

- Zoning Filters: Target sites based on allowable use and entitlement feasibility, especially valuable in dense or fast-growing areas.

- Environmental Risk Visibility: See flood, wildfire, wetlands, brownfields, and more before you engage capital or consultants.

- Market Demand Signals: Use permit activity, pricing trends, and absorption rates to prioritize high-opportunity submarkets.

From first-pass screening to underwriting, LightBox Vision lets your team go deeper, faster and build stronger business cases for each land play.

Uncover Ownership Blind Spots

Finding the perfect parcel is only half the battle. Getting in touch with the real decision-maker is where many deals stall, especially with LLCs, trusts, and multi-layered ownership structures. The Brookings Institution reported, “much of [U.S. real estate] is opaquely-held, with no way of determining the ultimate owner using publicly-available information,” raising transparency concerns that extend beyond compliance into the core of deal execution. This often leads to delayed deals, prevents early engagement, and costs developers time they don’t have.

LightBox Vision performs portfolio searches to obtain in-depth property insights including transaction history, mortgage details, and upcoming loan maturities. It connects people, properties, and portfolios to help investors see not just who owns what, but what that ownership means. Unlike legacy tools focused solely on contact data, Vision combines proprietary research with authoritative datasets to deliver actionable ownership insights across millions of commercial parcels.

This is a game-changer for:

- Off-market land acquisition

- Assemblage deals

- Entitlement partnerships

- Pre-negotiated land positions

“You can have the right site, the right zoning, and a ready team, but if you can’t reach the real decision-maker, the deal stalls,” Ammouri emphasized. “Ownership clarity is the final piece that turns a promising site into a real opportunity.”

Where Land Strategy Is Headed Next

With construction costs rising, utility access limiting feasibility in key markets, and ownership opacity still delaying early outreach, land strategy today is about executing a strategy with the right tools and acting with precision.

Even as these front-end challenges persist, deal activity across the broader CRE market is holding strong. The LightBox Transaction Tracker logged $160 billion in CRE transactions year-to-date through July, including a 10% increase in $50 million-plus deals from June to July. That momentum suggests investors are moving where fundamentals align, even as capital becomes more selective.

“We’re seeing a more disciplined market,” said Manus Clancy, head of Data Strategy at LightBox. “Capital is still in play, but it’s flowing to projects where teams can validate quickly, execute confidently, and move in step with local constraints. That’s what defines a competitive land strategy right now.”

Looking ahead, developers should keep a close eye on where permitting timelines, zoning pressure, and infrastructure limitations are affecting deal velocity. The next signal to watch is the August CRE Activity Index, which may show whether July’s momentum is holding or softening as summer draws to a close.

In a market where timelines are tight and margins are thinner, smart land strategy is about eliminating friction early and giving teams the tools they need to move faster, without second-guessing the fundamentals.

Ready to Power Your Next Land Play?

Let’s talk about how LightBox can support your acquisition strategy in 2025 and beyond.

Schedule a demo