Dianne Crocker, principal analyst, LightBox

I had the honor of kicking off the winter Environmental Bankers Association conference in rainy San Diego in front of leading environmental consultants and risk managers at banks and credit unions from across the US. My presentation, 2023 SET THE STAGE FOR A CHALLENGING 2024, highlighted the three phases of the post-COVID market, 10 trends that defined the commercial real estate investment and lending environment in 2022 (not good) and 2023 (even worse), as well as a look at what we can expect in the rest of 2024. Five highlights from my presentation and observations from the conversations that followed (as well as my favorite conference memory) are captured below:

- A palpable and refreshing sense of optimism: I couldn’t help noticing that EBA attendees were more upbeat about the market than they were at the summer conference in St. Louis. This is no doubt the result of the Fed’s recent pivot toward a rate-cutting strategy after years of hikes that resulted in 30-40% reductions in commercial real estate lending and investment activity in 2023.

- Liquidity should rise this year as rates fall with a lot of “if’s”: If interest rates and cap rates fall this year, it could boost property values, promote borrowing and move capital back onto the playing field. If the Mortgage Bankers Association’s January forecast hits the mark, CRE lending could rebound by 29% this year. Notably, that would be an uptick from the slowest year for CRE lending in roughly a decade, and it would bring lending to levels consistent with what we saw back in 2018. To be realistic, a deluge of new lending opportunities is unlikely. More likely is that we’ll see select financing for strong multifamily, industrial, and grocery-anchored retail assets in healthy markets, while borrowers will be hard-pressed to find financing for struggling Class B/C office assets in weaker markets and on properties with high vacancies. As one lender shared, “We’re really stuck in limbo with our originations until we see the Fed start to cut rates, and are bracing for a round of maturities this year.”

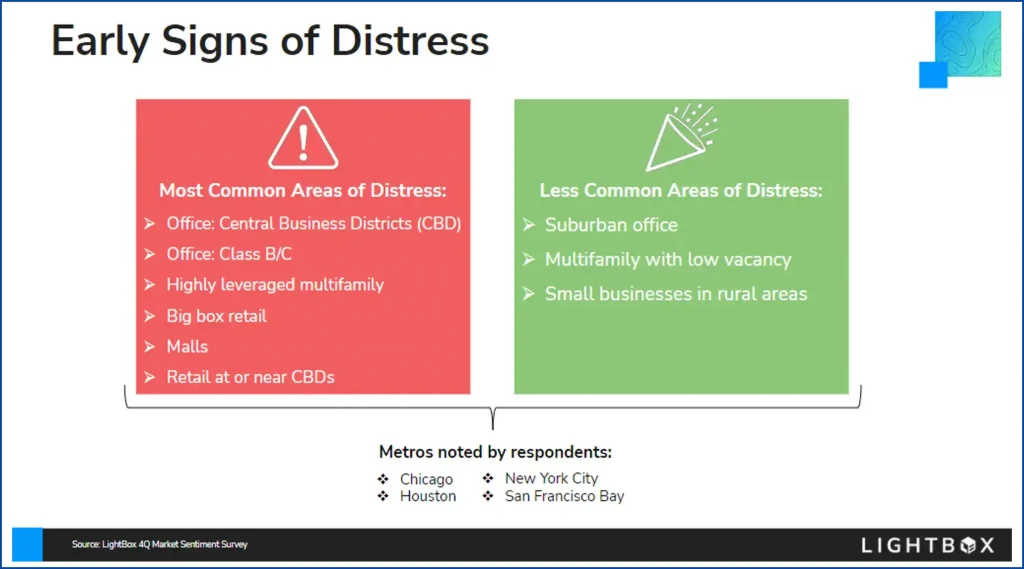

- Distress is very top-of-mind and investors are getting impatient. The modest increase in CRE lending forecast for this year won’t be enough to support near-term debt maturities so it’s not exactly a stretch to predict that distress will rise this year as loans that were originated at market highs struggle to refi at higher debt costs, falling valuations, rising operating costs and low occupancies in some cases. Thus far, the market has been able to delay the day of reckoning. As noted by Craig Benton, Sr. Director of Valuation at Synovus Bank in the LightBox 2024 CRE Predictions Report, “We keep hearing about this $4 trillion in commercial real estate that needs to be refinanced, but I haven’t seen a surge in activity yet.” The market is still early in the cycle of discovery, but distress is coming. Delinquencies are on the rise. Some loans will recover, and others will need to be dealt with via distressed sales, workouts or foreclosures. And when that happens, private capital is sending signals that it’s impatient to pounce on strong opportunities for ROI as they surface. Respondents to LightBox’s Fall Market Sentiment survey were already seeing some early signs of distress, particularly in downtown office, highly leveraged multifamily and big box retail.

- Skyrocketing insurance is pushing climate risk to the front burner. The number of billion-dollar climate events is growing at an alarming rate, and insurers are taking notice. In 2023, skyrocketing insurance rates on properties with high climate risk profiles came into play, and killed deals in states like CA, FL, and TX. A dramatic rise in operating costs due a spike in property insurance rates can present serious financial challenges to property owners, especially today when property prices are recalibrating. The fact that we were gathered in San Diego during a series of epic and severe rainstorms was not lost on EBA attendees with one noting, “It’s kind of fitting that we’re here now when sunny San Diego is getting pummeled so badly that hotels had to put out sandbags. The urgency of climate risk is pretty much right outside this hotel.”

As insurance becomes prohibitively expensive (or in extreme cases, unobtainable), it’s forcing the industry to come to terms with the challenges of insuring assets against growing climate risks. A building’s resiliency and sustainability is now correlated with an asset’s value in a way that it hasn’t been before, and new regulations, standards and guides will be a catalyst for assessing climate risk data at the building level during due diligence, especially as the FDIC remains focused on new principles for lenders on managing climate-related financial risks. Momentum is building here and it’s only going to get stronger.

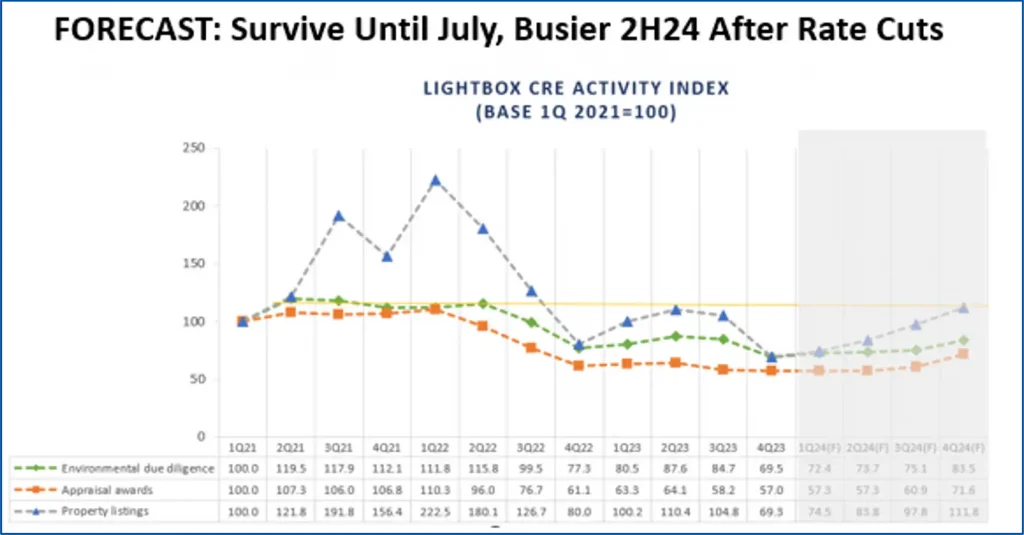

- Forecast for busier 2nd half only after interest rate cuts. The environmental due diligence consultants at EBA are gearing up staff to handle expected higher volumes of Phase I ESAs this year as the market limbo eases. Nearly everyone I talked to agreed that 2024 will be a key year for the industry, with the expectation that deal volume will accelerate materially as we move through the year. I shared the new LightBox CRE Activity Index, a new measure of changes in activity across Phase I ESAs, lender-driven appraisals and property listings across various LightBox platforms. The Index has a forecast module (shown in the shaded portion of the accompanying graph) that highlights how I expect 2024 will play out. If the Fed cuts rates in Q2, the first market reaction would likely be an uptick in the property listings in our broker/investor platform as sellers put more assets on the selling block. After that, it’s reasonable to expect an uptick in environmental due diligence and appraisals to support a new round of dealmaking late in the year. The index will be updated at the close of each quarter, with the forecast redrawn as we learn more about the Fed’s plans for interest rate cuts this year and other market developments. Transaction volume, price appreciation, and a lower-than-expected default rate could be pleasant surprises in 2024, but until we see rates come down, we are not likely to see much change in transactions and lending. And separate from interest rates, the CRE industry continues to adjust to new dynamics that open up opportunities for site redevelopment and reuse across asset classes and metros.

Top EBA Moment

The EBA conference in San Diego presented a special moment for some of the awesome mentors who volunteer their time to the LightBox Developing Leaders program to connect in person as we welcomed 2 of our newest mentees, Courtney Milot and Michael Liston, into the fold. Our program is in its 5th year, and some of the mentors have been with us right from the start. The best quote of the evening came from TRC’s Dale Allison: “At the end of my career, it won’t matter how many clients I had or projects I worked on. It’s the mentees I’ve had through the years. That’s my true legacy.”

FOR MORE INFORMATION

To receive the latest LightBox Market Insights, including our new Phase I ESA quarterly snapshot report series, subscribe to LightBox Insights: Insights | LightBox (lightboxre.com)