As environmental, social, and corporate governance (ESG) strategies continue to grow more popular, investors are increasingly adding the concept of “resiliency” to the equation to account for the fact that dealing with climate change goes beyond supporting companies reducing carbon emissions or taking other steps to stop rising temperatures. It’s also necessary to manage the problems climate change has already caused and to prepare for inevitable challenges in the future. For example, ESG+R investors might look for companies that carry enhanced flood insurance for higher-risk buildings, are transparent in their disclosures to investors and tenants about how they’re mitigating climate risk, and support scientific research and mapping efforts to help them properly deploy resources.

At LightBox, we view the concepts of ESG and resiliency as separate but related. Looking at commercial real estate through an ESG lens helps us understand the industry’s impact on the environment and how it might work to reduce emissions. Our focus, which includes partnering on a project with the Oak Ridge National Laboratory, is to support measurement and reporting of greenhouse gas at a nationwide scale.

On the other hand, we want to help prepare the commercial real estate industry to manage and mitigate the current and future impact of climate change on the environment. That’s where resiliency comes in. Our data and analytics support climate modelers in their effort to screen and identify properties and value at risk.

ESG Case Study: LightBox and the Oak Ridge National Laboratory

To better understand emissions on a national scale, Oak Ridge created a “digital twin” of the nation’s buildings. This software suite, Automatic Building Energy Modeling, or AutoBEM, uses high-performance computing to process layers of imaging data with information about individual buildings, such as their size, use, construction materials, and heating and cooling technologies.

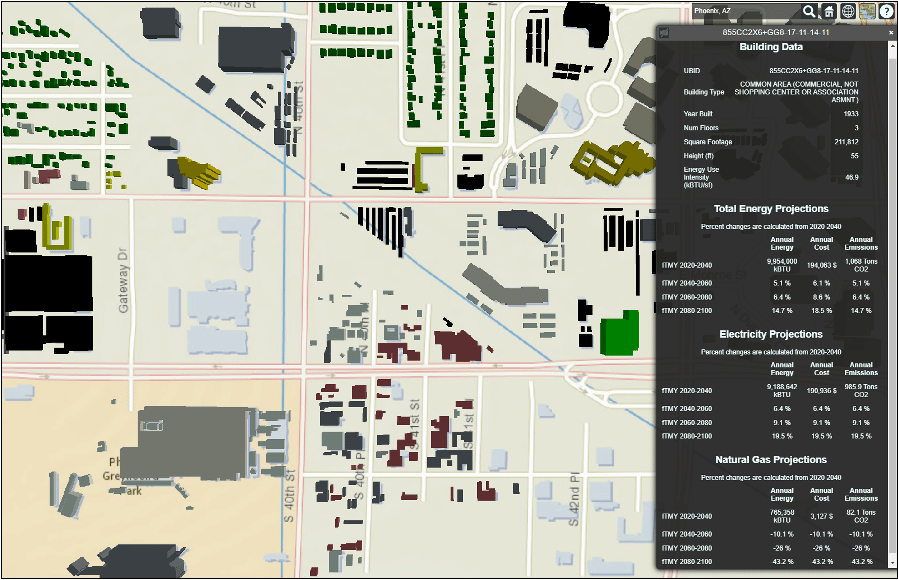

AutoBEM incorporates climate change scenarios identified by the Intergovernmental Panel on Climate Change, modeled by the Climate Change Science Institute at ORNL. This feature attracted our attention and we provided new data sets—including building footprints, interior details, property parcel boundaries, and financial information—that are critical for understanding new risks. We plan to use AutoBEM to model the long-term energy and operation costs of buildings and to support understanding and reporting greenhouse gas emissions, providing valuable information to real estate investors, brokers, lenders and banks, appraisers, engineers, and environmental consulting firms, many of whom must provide climate-related data to regulatory bodies such as the Securities and Exchange Commission, the Task Force on Climate-Related Financial Disclosures, the Federal Deposit Insurance Commission, and the Office of the Comptroller of the Currency.

LightBox will make AutoBEM output available via bulk feed and through our developer portal. Outputs include energy consumption in kBTUs; cost by energy type, electricity, and natural gas; consumption by purpose (heating, cooling, total); carbon dioxide emissions in tons (overall, electric, and natural gas); and total heating degree days and cooling degree days.

We anticipate several use cases:

- Property profiling: would include estimates of current energy consumption and GHG emissions in total and by energy source for property- and portfolio-level review.

- A benchmarking tool: would offer the ability to compare current and projected energy consumption and GHG emissions against similar properties and market averages, and to gauge performance over time.

- Mortgage default modeling: would help customers determine total cost of ownership and commercial and multi-family debt-service coverage ratios.

- Long-term meteorological forecasts: would offer typical and future meteorological-year data at the metro-area level.

Resiliency: ESG solutions to help the CRE industry manage the impact of climate change

Climate modeling is a crucial tool for entities seeking to mitigate the effects of climate change. Modelers are most often interested in three things: how to characterize potential property losses, property boundaries for creating building level forecasts, and transaction histories for financial research. LightBox offers several solutions, including curated datasets for data modeling and reporting that cover boundaries, neighborhoods, property, and environmental.

SmartFabric integrates the breadth and depth of our geospatial data to provide the most accurate location intelligence available in one place. Our Developer Portal offers cloud-based APIs that provide access to core LightBox datasets and geospatial matching capabilities. LightBox Identifier provides users with data that includes unique identifiers connecting third-party, public, and customer data with our proprietary content, while Match & Append enriches any important entity—such as a property or a customer insight—to provide intelligence that will have an impact on strategy.

To help organizations create resiliency plans, LightBox provides data to non-profit and for-profit organizations for flood, wildfire, and heat stress modeling. We were a participant in the American Society for Testing and Materials Property Resilience Assessment (PRA) task group and an aggregator and distributor of Federal Emergency Management Agency Risk Index and other peril data sites.

Commercial real estate is uniquely susceptible to the effects of climate change, and fostering resilience will play a key role in future efforts by the private- and public-sectors to mitigate the dire effects of a warming planet on property, infrastructure, and people. LightBox data and solutions are already playing a central role in efforts by governments and businesses to plan and prepare for the future so they can better manage risk—and we look forward to expanding our footprint in this area.