As data centers become the backbone of the digital economy, the decision of where to build them has never been more critical. Rental rates for data centers are projected to increase by 14.5% year over year, according to CBRE, reflecting the growing demand for strategically located land that can support these complex facilities. In addition, JLL reports that the compound annual growth rate (CAGR) for the data center market is expected to rise by 11.3% between 2021 and 2026, underscoring the scale of this expansion. Whether in rural areas offering cost-efficiency or urban centers providing proximity to key markets, companies like Amazon and Microsoft, to name a few, are navigating factors like power availability, connectivity, and complex zoning laws to secure optimal sites for their growing infrastructure needs.

Scale and Infrastructure Rank High in Data Center Requirements

One of the most pressing challenges in data center development today is finding land with access to robust infrastructure. As demand for hyperscale data centers grows, the need for vast amounts of electricity and connectivity becomes paramount. Data center providers have been facing mounting challenges in securing enough power, even before the rise of AI. Now, with AI’s exponential data processing demands, finding suitable land with ample power capacity is an even bigger hurdle.

Microsoft, for example, is investing billions in new data center developments to support its AI platforms like Azure and ChatGPT. Recent acquisitions, like its $3.3 billion purchase of 173 acres of land in Mount Pleasant, Wisconsin, reflect the scale of investment required. Additionally, companies like EdgeCore Digital Infrastructure are acquiring hundreds of acres to build expansive campuses, as seen with their recent 120-acre purchase in Virginia’s Tech Zone (CTZ)—a designated 690-acre section of land that utilizes existing infrastructure to concentrate all data center development within a single area.

Data centers of the future require land with room for significant growth—10 acres is typical. Ideal sites often need to accommodate up to 1.4 million square feet of space and over 300 MW of power to meet the needs of hyperscale customers. These factors—ample space, proximity to power grids, and access to fiber networks—are crucial in site selection.

Urban vs. Rural: The Debate Over Location

Traditionally, data centers have been built on sprawling rural land to minimize costs. Land in rural areas is cheaper, and power is often more available. However, as data center operators seek to move closer to urban hubs, they face higher real estate costs and new logistical challenges. This shift is driven largely by the growing demand for low-latency applications that require data centers to be near major population centers. Amazon’s recent exploration into building a massive campus in Northern Virginia highlights this trend. Despite stricter zoning laws, data center operators are willing to pay more for prime locations near tech hubs.

In contrast, many large-scale data centers are still going up in less densely populated areas like Virginia’s CTZ, where zoning has been proactively designed to address community concerns before development starts. This kind of forward-thinking zoning allows developers to avoid the opposition often seen in more populated areas.

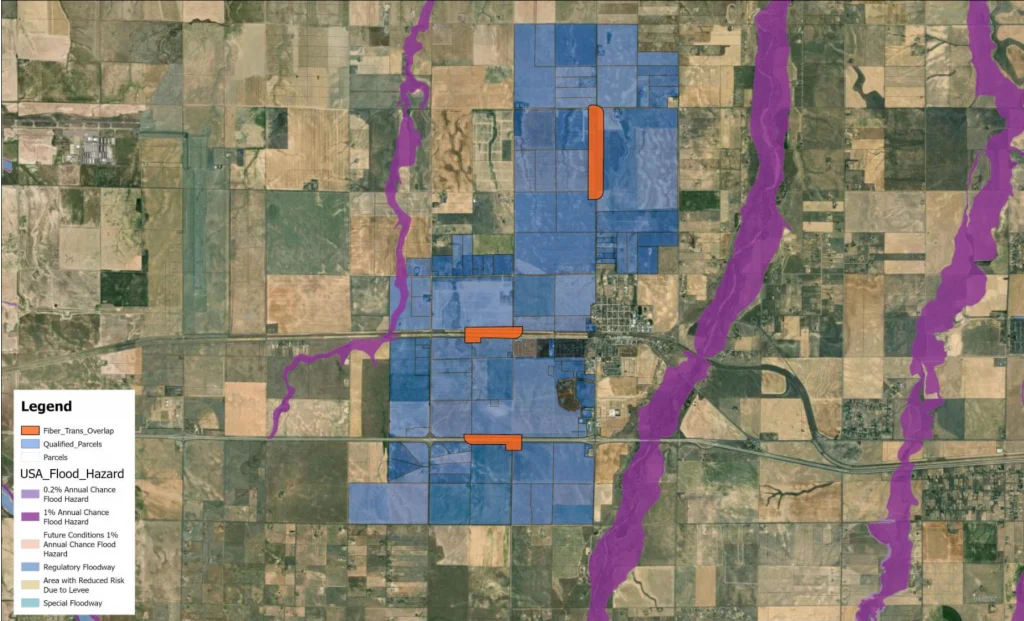

Another consideration for site selection is to determine where environmental and natural hazards are located. Considering data on flood zones, for example, will help a developer better understand where these qualified properties intersect with environmental and natural hazards.

Vertical Growth: A New Trend in Data Center Construction

As space becomes a premium in urban areas, some data centers are beginning to go vertical. Traditionally, data centers have been low-slung, single-story buildings. However, developers in cities like New York and Chicago are now considering multi-story data centers to meet increasing demands. While building vertically introduces new challenges—such as higher costs for materials and power infrastructure—it offers a solution for some data center operators to stay closer to the populations they serve, as explained by Dan Drennan, a principal and data center sector leader at design firm Corgan. Developing data centers in urban areas reduces lag time and improves connection speeds for city residents and businesses, as well as making it easier to find workers to staff the facilities due to the larger labor pools in these regions.

The urbanization of data centers marks a significant shift in how these facilities are developed and the types of land they require. While rural sites still offer the best cost-per-megawatt efficiency, urban locations allow operators to position their services closer to where they are needed most.

Securing Enough Energy for Powering Data Centers

Power availability is a critical factor when determining the right land for a data center. The global demand for electricity to support AI and cloud applications has created a “fever pitch” in the market, according to Wes Cummins, CEO of Applied Digital. Cummins warned that the race to secure power will only intensify as more companies deploy large-scale GPU stacks, which are crucial for AI.

Some companies are exploring creative solutions to overcome power shortages. For instance, Amazon recently announced a partnership with Dominion Energy to explore small modular nuclear reactors (SMRs) as a sustainable power solution for their data centers . This bold move underscores the lengths to which operators are going to ensure they can secure enough energy to power their operations.

As data centers become the backbone of the digital economy, finding the right land for these facilities is more important than ever. Developers must consider not just the immediate costs but also the long-term availability of power, the proximity to connectivity hubs, and the potential for future expansion. Whether rural or urban, the land selected for data centers will play a pivotal role in shaping the next wave of digital infrastructure.