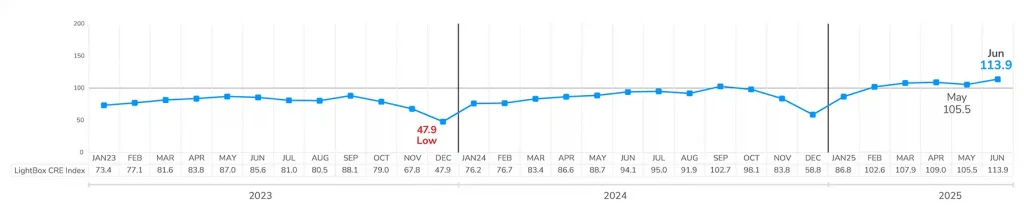

The LightBox CRE Activity Index surged to 113.9 in June, its highest reading of 2025 and its strongest performance since May 2022. This powerful mid-year rally signals that today’s commercial real estate market velocity is regaining strength despite tariff-led volatility, sentiment headwinds, and economic uncertainty.

The Index is 21% higher than year-ago levels, a sign that the market is not just weathering the storm but recalibrating and setting the stage for a stronger second half of 2025. While uncertainty remains elevated, from tariff fallout to the unknown timing of interest rate cuts by the Federal Reserve, deal-making and the critical functions that support it remain strong.

The Index measures the aggregate daily activity across three core CRE functions, environmental due diligence, commercial property listings, and lender-driven appraisals, amounting to more than 30,000 data points in June supporting CRE lending and investment.

Resilient CRE Market Amid Growing Uncertainty Over Tariffs and Broader Economy

The CRE Activity Index is based on the average daily volume over the past month in each of the three functions that support CRE lending and investment:

- Commercial property listings rose for the sixth straight month, with daily volume up 2% from May and 31% higher than last June, when many sellers stayed on the sidelines awaiting the Fed’s first interest rate cut and greater pricing clarity.

- In a promising sign of renewed momentum in early-stage CRE deal flow, Phase I ESA activity rebounded sharply, rising 10% from May after a sluggish spring marked by a 5% drop in April and a modest 1% gain in May.

- Lender-driven commercial appraisal volume bounced back strongly with a 19% month-over-month increase, reversing May’s 19% decline in a sign of financing activity reaccelerating after a volatile April.

Monthly LightBox CRE Activity Index (January 2021 – Present)

Dianne Crocker

LightBox Research Director

“We’re seeing investors reenter the market now that pricing has found a footing. Banks are slowly coming back, and they’re being joined by debt funds and CMBS lenders, all helping to restore the liquidity needed for both new originations and a wave of upcoming maturities.”

FORECAST: “Steady On” as Strong June Sets the Stage for a Busy Second Half of 2025

The Index, supported by a broad base of data on early indicators like property listings, appraisals, and environmental due diligence, points to an active stream of deal closings in the months ahead. If anything upsets the market in the coming months related to trade or monetary policy, the economy or overall sentiment, any noticeable change will show up in the Index. The strong June Index is a sign that CRE investors are still active, albeit with eyes wide open. Lenders are more risk averse, and underwriting is tighter, but they are still willing to extend capital when the numbers make sense. While risks remain, from inflation and tariffs to geopolitical unrest and interest rate surprises, the foundation is in place for continued deal flow in the coming months. The LightBox CRE Activity Index offers evidence that the CRE market is soldiering on, with discipline and direction, even under clouds of policy and economic uncertainty.

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.