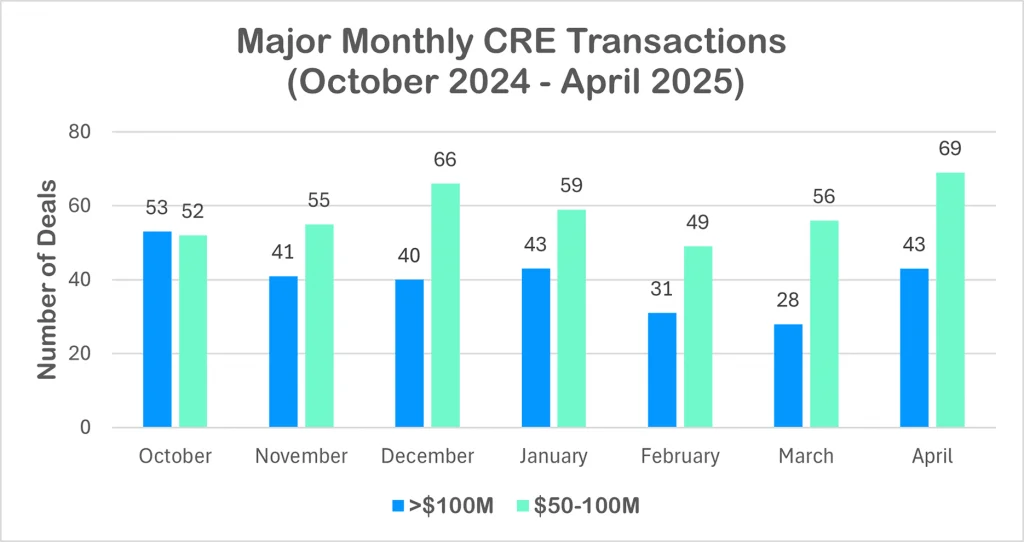

After losing some steam in February and March, the CRE market didn’t slow further in April—it shifted gears. Rather than retreating, deal activity recalibrated, with a noticeable pivot toward mid-range transactions. While the pace of $100M+ deals eased slightly from earlier in the year, momentum in the $50M–$100M bracket surged, driving overall volume to a new peak.

According to LightBox data, 43 nine-figure deals and 69 mid-range deals closed in April—both up from March. With 112 major transactions, it was the highest combined monthly volume since LightBox began reporting the statistic in October 2024. The data underscores a market where capital remains active, but more strategically deployed.

These trends align with the latest reading of the LightBox CRE Activity Index, a composite measure of market velocity based on property listings, appraisals, and environmental due diligence volume. In April, the Index rose to 109, its highest level since June 2022, signaling continued deal activity—even as growth moderates.

“Despite a noisy macro backdrop, April’s Index shows that commercial real estate activity is still advancing,” said Manus Clancy head of Data Strategy at LightBox. “The momentum from earlier in the year hasn’t vanished—but the tempo has clearly slowed as caution sets in.”

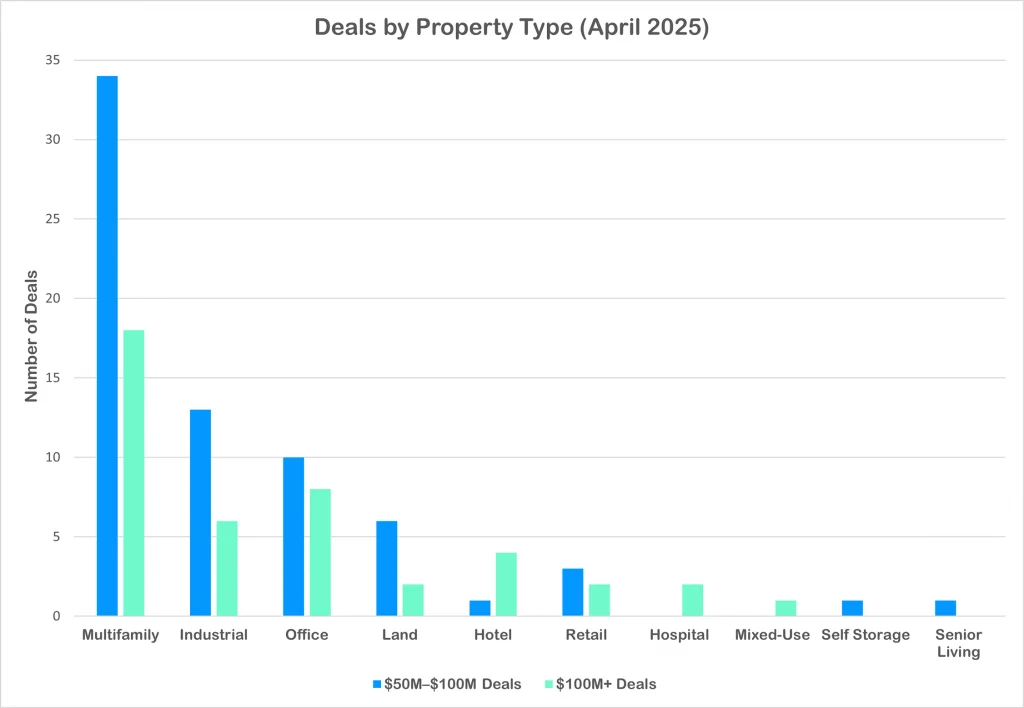

Where the Money Went: April’s CRE Deal Volume by Property Type

The chart above highlights the distribution of April’s major CRE transactions by property type and deal size. Multifamily led by a wide margin, with more than 50 deals across both tiers—as investors seek stable returns, play the long game on housing demand, and capitalize on more favorable pricing in a recalibrating market.

Industrial and office rounded out the top three, with office surprisingly recording 18 major trades—a sign that capital is still flowing to well-leased, well-located buildings, especially in life sciences and core urban markets. Industrial remained a favored target for institutional buyers, fueled by low vacancy rates and limited new supply.

Activity in land, hotel, and retail was more sporadic but still notable, pointing to selective plays in redevelopment and lifestyle-driven sectors. While asset performance varies widely, one thing’s clear: capital hasn’t disappeared—it’s just getting sharper, faster, and far more strategic.

Multifamily: Still a Volume Leader in Major Markets

Multifamily continues to dominate major CRE transaction activity, buoyed by resilient demand, demographic tailwinds, supply constraints as construction starts slow, and a flight to stable income-producing assets. In April, multifamily accounted for 18 of the 43 nine-figure transactions and 34 of the 69 $50M–$100M deals—making up nearly half of all major CRE deals for the month. Investors showed strong interest in urban-core towers and West Coast communities near tech hubs. Recent CBRE data underscores the sector’s resilience, with net absorption hitting 100,600 units in Q1 2025—the strongest first-quarter performance in over two decades—and vacancy tightening to 4.8% as demand continues to outpace supply. These conditions help explain why multifamily made up nearly half of April’s major CRE transactions.

- Jersey City, NJ: Veris Residential acquired the remaining 15% stake in the 762-unit tower from Ironstate Holdings, reflecting a full property valuation of $256.7 million. With waterfront views, a rooftop pool, boutique retail tenants, and proximity to PATH and light rail, the asset offers a lower-cost alternative to Manhattan rentals.

- Santa Ana, CA: Essex Skyline at MacArthur Place, a prominent two-tower, 350-unit high-rise in Santa Ana, California, was sold for $239.6 million. Originally developed as condominiums in 2008, Essex Property Trust acquired the property in a joint venture in 2010 and subsequently converted it to multifamily rentals. By 2012, Essex had assumed full ownership. The 25-story towers remain the tallest buildings in Santa Ana and are situated near John Wayne Airport and several parks.

- Cupertino, CA: A 468-unit apartment community near several Apple office campuses changed hands for $207.2 million. The deal reflects continued investor demand for multifamily assets in supply-constrained tech corridors.

Industrial: Big Bets Persist Despite Headwinds

Industrial remained one of the most actively traded sectors in April, accounting for 6 of the 43 nine-figure deals and 13 of the 69 transactions in the $50M–$100M range. With construction starts down more than 80% from their 2022 peak, according to CBRE, and vacancy holding near historic lows in key logistics markets, institutional capital continues to target the sector’s long-term upside.

- Top 5 Largest Deals: One of April’s five largest CRE transactions was in the industrial sector: a six-million-square-foot Texas portfolio acquired by Blackstone for $718 million, reinforcing investor conviction in supply-constrained distribution hubs—even amid tariff uncertainty and rising delivery costs.

- Inland Empire: A bellwether market for U.S. logistics—an 889,000-square-foot warehouse in Riverside sold for $257 million, more than doubling its previous sale price of $117 million. The property, with 40-foot clear heights and 220 dock doors, fetched $289 per square foot—a clear reflection of tenant demand in one of the country’s tightest industrial markets.

- Institutional Confidence: Blackstone made headlines with a $718 million acquisition of a 95% stake in a 6 million-square-foot industrial portfolio developed by Crow Holdings. The 25-property portfolio, concentrated in Dallas and Houston, adds to Blackstone’s already massive U.S. warehouse footprint and reinforces its bet on logistics as a long-term growth engine—even amid tariff uncertainty and mixed near-term fundamentals.

Office: Signs of Life in a Still-Challenging Market

Office remains the most scrutinized asset class in CRE—but April showed that capital hasn’t fully retreated. With 8 nine-figure deals and 10 more in the $50M–$100M range, investors are still writing checks for well-leased, high-quality assets—particularly in life sciences and top-tier urban markets where fundamentals are holding firmer than the headlines suggest.

- San Diego, CA: BioMed Realty acquired Pfizer’s five-building biotech campus in Torrey Pines for $255 million, expanding its presence in a core life sciences market where demand remains resilient.

- Boston, MA: In the city’s Financial District, the 32-story tower at 99 High Street traded for $227 million, marking a roughly 17% decline from its prior valuation. Still, with 78% occupancy and a tenant roster that includes AIG, Marsh McLennan, and Karuna Therapeutics, the deal highlights that well-leased urban assets are still attracting interest—even amid broader office headwinds.

Luxury ‘Land Grabs’ Emerge in Hotel and Condo Crossovers

April also saw a notable oceanfront redevelopment as Terra and Fortune International acquired the Silver Sands Beach Resort in Key Biscayne, Florida, for $205 million. The 3.8-acre site—currently home to a 56-room motel—will be replaced by a 13-story, 56-unit luxury condominium, marking the first new condo project on the island in over a decade. With approved entitlements and a high-end design team in place, the deal reflects a long-term bet on ultra-luxury coastal living, even as broader hotel fundamentals remain mixed.

Will May Build on April’s Momentum?

Investor selectivity is sharpening, but the CRE pipeline is far from dry. If multifamily’s momentum continues and industrial fundamentals hold, May could bring even more clarity on which sectors are poised to accelerate—and which are nearing a reset. Office trades, while selective, are setting new pricing benchmarks, and land-driven redevelopment is beginning to test the waters in high-barrier markets.

“April marked the first full month following the tariff announcement, and CRE activity is still holding steady,” said Manus Clancy. “If the wheels stay on through May, confidence could begin to return and bring with it tighter spreads, more lending, and a gradual return to normalcy.”

The next few weeks will offer key signals: how lenders respond to deal momentum, whether volatility spills into valuations, and how long capital continues to move with this level of discipline. Stay tuned—May might be the market’s first real inflection point of 2025.

Want the full list of April’s nine-figure CRE buyers—plus insights on $50M–$100M deals?

Subscribe to LightBox Insights to get the full list and future updates delivered straight to your inbox. Stay tuned for next month’s edition—and catch our podcast, The CRE Weekly Digest, for expert analysis on deal trends across the market.