Slow start to 2023 with all eyes on interest rates, delinquencies

Commercial real estate activity slowed dramatically over the past several quarters, as interest rate hikes and overall economic headwinds sent investors to the sidelines and constrained liquidity. This blog looks at the key issues impacting the industry and what’s ahead for the remainder of 2023.

- Rising interest rates are challenging debt financing, and lenders have adopted a more risk-averse stance given market instability.

- Bid-ask spreads are wider than they’ve been in many years, impeding deal flow.

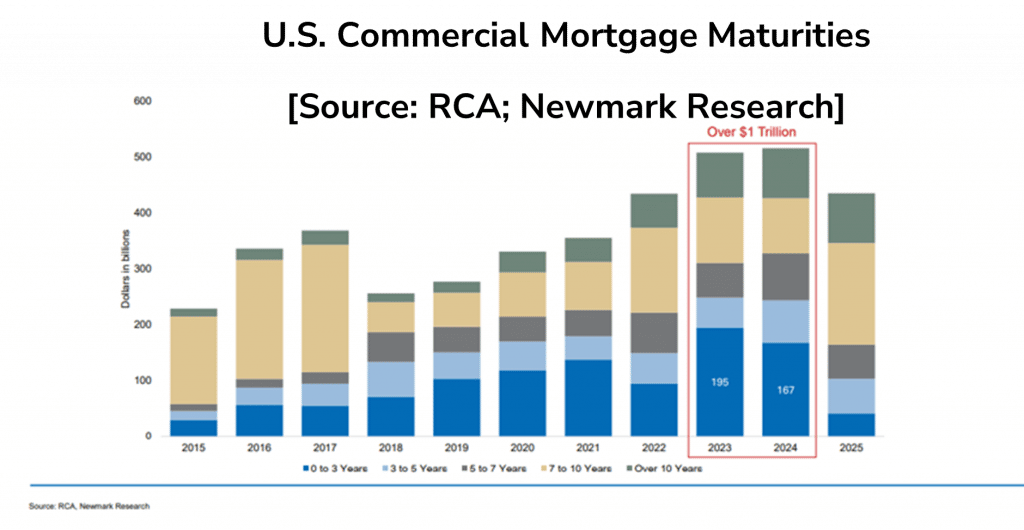

- The more than $1 trillion wave of commercial loans slated to come due over the next two years will face obstacles getting refinanced, given the higher rates and economic uncertainty.

The big question on everyone’s mind: What will it take to reignite commercial real estate lending and investment activity?

Lending trends downward

Projections on market activity have shifted dramatically from a year ago when the Mortgage Bankers Association (MBA) optimistically forecast that commercial property lending would break the $1 trillion threshold for the first time ever. After several adjustments in the second half of the year, the MBA adjusted its forecast downward as interest rates grew, along with market uncertainty. By year-end, lending activity fell by 17% below 2021’s record levels. The MBA’s latest forecast from early January predicts a modest decline this year, and pushes off a recovery until 2024, giving the market time to adjust to the impact of rising interest rates. Total mortgage lending in 2023 is now expected to reach $887 billion, a 5% decline below 2022 levels (11% for multifamily), and then rebound by 27% next year.

As a potential price correction looms, a bid-ask spread has developed between buyers and sellers, with each side trying not to lose too much ground. Commercial properties are set for a repricing that could be as dramatic as 20-30% for office, and less dramatic for other asset classes. A reset on prices could increase buyer momentum and trigger a reshuffling of asset classes toward core assets that had been richly priced. There is a clear bifurcation in the assets in demand with investors favoring high-quality assets while other sectors with high vacancies will struggle, particularly with operating costs increasing.

Drastic and sudden shift in lenders’ risk tolerance

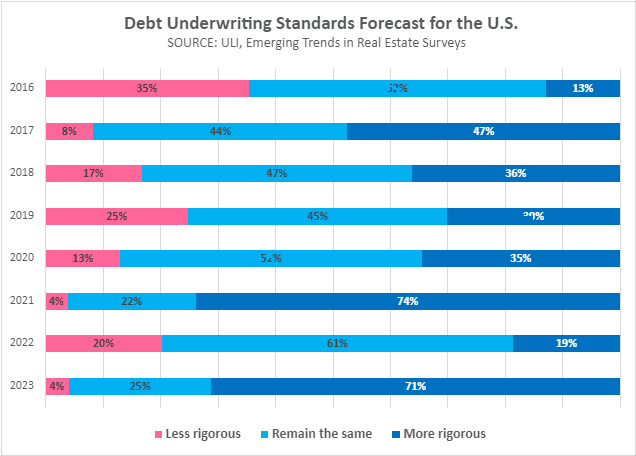

The recent results of the Emerging Trends in Real Estate survey revealed that lenders responded to the rapid changes in the market last year with a lower risk tolerance. Based on the latest findings, 71% of investors reported “more rigorous” debt underwriting standards in 2022 compared to only 18.6% in 2021 [Source: ULI]. This reflects a return to extremely cautious lending climate that took root immediately following the COVID health crisis during the 2021 recovery period.

As caution and uncertainty continue to dominate market sentiment, all eyes are on interest rates and property pricing. Here are a few factors to keep an eye on as the year unfolds.

What to watch in 2023

- Loan originations: While the MBA is now predicting a 5% drop in commercial property originations this year, expect the association to reforecast over the course of the year as the market adjusts to changing conditions. The next forecast is expected in the second quarter and it will be interesting to see if the forecast switches to a low-growth forecast if the market gets more clarity on interest rates and pricing toward mid-year.

- Fed’s interest rate strategy: The MBA’s predictions will be largely dependent on the Fed’s interest rate decisions given the trajectory of inflation. If inflation continues to stabilize, Fed chairman Powell’s rate hikes will likely moderate, as they did at this week’s FOMC meeting with only a 0.25 bps increase. If the market gets a sense that the steep rate rises of 2022 are in the rear-view mirror, it could fuel the perception that the cost of capital won’t rise much further, and be an impetus for capital to move back onto the playing field. Future rate decisions will be very telling.

- Loan maturities and distress: Trepp closely tracks CMBS loan delinquencies which were 3.04% in December, a slight increase over November, but still relatively low compared to the COVID high of 10.3% in June 2020. Loan delinquencies are expected to continue rising in 2023, and the biggest impacts could come from the more than $1 trillion in loans slated to come due over the next two years. Given higher interest rates and economic uncertainty, many maturing loans will face challenges getting refinanced. That is particularly true in the office and retail sectors where fundamentals and future demand remain unclear.

“We estimate that $10 billion in CMBS office loans in NYC are about to mature with no option to extend so it’ll be interesting to see how lenders respond to that. It’s a sign of what’s coming down the pike. The full weight of the impact will come to bear on the market.”

Environmental due diligence activity shifts

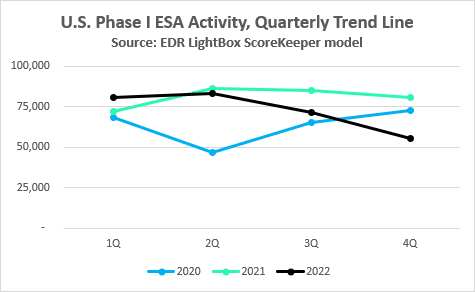

The deep freeze in commercial property transactions and loan originations that the market experienced in the second half of 2022 also impacted environmental due diligence volume. Based on the latest results from the LightBox ScoreKeeper model, which tracks trends in the volume of environmental due diligence across the U.S., the differences in how the past three years played out is evident. This graphic shows how U.S. Phase I ESA activity in support of lending and investment activity shifted from the COVID-led shutdown in 2020 (blue line) through recovery in 2021 (orange line) and early 2022 (gray line). By mid-2022, however, higher rates and uncertainty drove investors to the sidelines and drastically restrained activity in the 4th quarter—typically the busiest quarter of the year.

The lending climate is clearly more difficult than it was at the start of 2022 given the rise in interest rates and the correlating uncertainty and instability in the market. Price discovery is difficult, particularly given the low levels of transactions, and bid-ask spreads are wider than they have been in many years, which will continue to impede deal flow.

The key factors that could signal a change in market dynamics and drive higher lending and investment activity are:

- More clarity on the timing and pace of future Fed interest rate increases.

- Continued assurances that inflation peaked and is not likely to change direction.

- Clarity on where the reset on property pricing and valuations will land, particularly in office and retail.

- The timing and duration of a potential recession later this year.

The Fed’s decision this week to raise rates only by a quarter-point was an important first step in building the market’s confidence that the rate of increases is plateauing. The MBA’s forecast of a 5% decline in lending this year reflects the schedule of maturities in a higher interest rate environment and more constrained liquidity than we’ve seen over the last cycle. On the transaction front, it will take time before the market has enough data to narrow the gap that exists between sellers’ price expectations and what buyers are willing to pay. Until the market recalibrates and confidence returns, capital will be reluctant and transaction activity will likely be dominated by cash buyers and opportunistic investors. Given the uncertainty about the economic forecast and continuing recession fears, caution is called for and thorough due diligence is paramount to ensure that deals pencil out.

It’s a challenging start to 2023 because everything we knew to be true about the market one year ago doesn’t hold up anymore. Commercial property lenders and investors are digesting rapid change and rising risk as we enter a new real estate cycle. This year and next will bring a peak in loan maturities seeking refinancing under higher rates, and significant opportunities to renovate and repurpose assets that serve the needs of today’s commercial real estate demand, particularly in office and retail.