The third quarter of 2024 was characterized by mixed barometers on the economy, the labor market, and consumer spending, as well as several notable disruptions. Despite the volatility, the commercial real estate (CRE) industry showed encouraging resilience, and the LightBox Commercial Property Listings Index closed out the quarter with a continuation of the growing momentum of the first two quarters of the year.

By the end of the quarter, the volume of commercial property assets brought to market on the LightBox RCM platform increased by 12% compared to one year ago, the majority of which were multifamily, industrial, and retail properties, signaling a willingness by sellers that was largely absent in 2023. Bid-ask spreads are slowly narrowing, property prices are stabilizing, and investors, encouraged by the rate cut and improving economic conditions, are showing more interest in pulling the trigger on deals in a way that they weren’t at this time last year. This added up to a steady flow of refinancing and transactions. A LightBox analysis of September deal volume highlighted 29 sales of $100 million or more, with the average transaction valued at almost $185 million, and activity that cut across all asset classes and geographies.

Our latest CRE Market Snapshot on capital markets and investment includes industry benchmarks, as well as the latest insights and forecasts.

Key highlights:

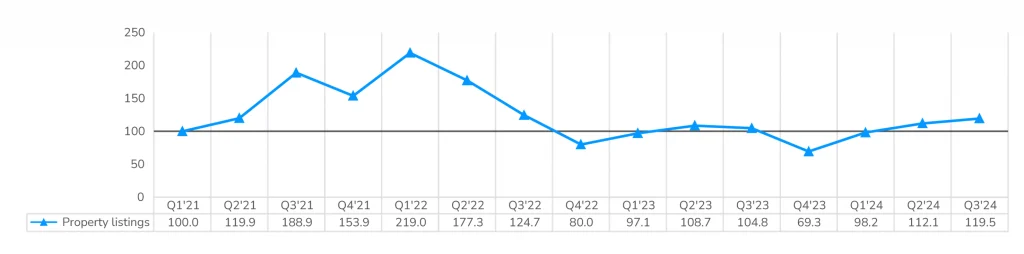

- The LightBox Commercial Property Listings Index rose 14.7 points to 119.5 in Q3 2024 from 104.8 one year ago—and 7.4 points from 112.1 in Q2.

- Sellers, encouraged by pricing clarity and an expanding universe of buyers, brought more properties to market with the total volume of property listings up 12% year over year and 3% compared to Q2 2024.

- LightBox CRE Market Advisory Council members gave CRE market conditions an average score of 70 in Q3 on a scale of 1 (worsening) to 100 (improving) amid improving market sentiment.

- Land and multifamily property listings experienced the most significant quarter-over-quarter increases in listings volume, up by 18% and 8%, respectively.

- LightBox RCM property listings priced below $20 million increased to 61% of total listings, a sharp jump from 48% one year ago. Multifamily and retail collectively accounted for a sizable 46% of Q3’s smaller listings activity.

Lightbox Commercial Property Listings Index Continues 2024 Trajectory

After the three-year low in Q4 2023, the latest quarter marked the third consecutive quarter of increases in the LightBox Commercial Property Listings Index. The Q3 Index reached 119.5 compared to last year’s 104.8 and the previous quarter’s 112.1. It is worth noting that the Index grew in Q3 despite the fact that 2024’s first cut in interest rates did not materialize until the end of the quarter. The third quarter results were also the first time in three years that there was a Q2-to-Q3 increase in listings activity, a sign of anticipation leading up to the rate cut. The expectation of two more cuts in Q4 will likely continue the 2024 momentum as more deals pencil out in the new falling rate environment. These observations are consistent with the LightBox CRE Monthly Activity Index tracking the velocity of key functions supporting CRE transaction activity that has been inching up since March.

LightBox Commercial Property Listings Index (base Q1 2021=100)

“The rate cut will get the headlines, but other factors, such as the re-emergence of banks, are tightening loan spreads and bringing us closer to neutral leverage for borrowers. This will help buyers meet seller expectations and close the bid-ask spread between buyers and sellers. We’ve been stuck in price discovery for almost two years, and this is a promising development.”

– Bryan Doyle, Managing Director, Capital Markets, CBRE

Slow and Steady Recovery Through Year-End with Modest Rate Cuts

The market is only one month into responding to the first interest rate cut, and change is not going to happen overnight. Despite myriad market challenges, there is also a strong case for guarded optimism. The strength of the LightBox Commercial Property Listings Index in Q3, coupled with the likelihood of more rate cuts at the November and December Fed meetings, lays the foundation for stronger lending and transaction activity through year-end and into 2025.

As this new growth cycle for CRE gets underway, the strongest point in favor of future CRE transactions growth is the sheer volume of capital raised to take advantage of opportunistic investments. Eventually this capital will be deployed depending on how quickly assets are made available to willing investors. As interest rates come down, the math behind deals will work better than it has in the past few years. In terms of geographic trends, post-COVID shifts in population, talent, manufacturing, and building will be pivotal in steering investors to the next round of opportunities. Metros like Austin, Phoenix, Dallas, and others that combine a strong manufacturing base, and intellectual capital will attract the attention of investors.

The forecast for the LightBox Commercial Property Listings Index is somewhat dependent on future rate cuts and the pace of property investment opportunities. Barring an unforeseen market shock, it is reasonable to assume modest Q4 growth given the positive forces supporting CRE investment over the near term. The first rate cut was a small but important step away from the days of high debt capital costs challenging transactions and property values, but there is typically a market lag with respect to interest rate shifts, so it will take time. Recovery will also not be uniform and will vary by investor type, asset, and location. CRE professionals can take solace in the fact that the market is more optimistic than it has been in years and that Q3 set the stage for the pool of investors to expand with stronger transaction and lending velocity to follow along with greater access to capital as the widespread transfer of CRE assets continues.

This analysis is part of the LightBox Quarterly CRE Market Snapshot Series, which provides insight into activities that support commercial property dealmaking. The data presented in the Focus on Capital Markets and Investments are derived from the activities of the LightBox RCM platform and used to calculate the LightBox Commercial Property Listings Index. LightBox RCM is the industry’s leading go-to-market listing platform that powers investment sales, as well as debt and equity deals. As a trusted CRE technology solution, LightBox RCM offers a global marketplace for buying and selling CRE and increases the speed, exposure, and security of deals through one streamlined online platform. Brokers can leverage integrated property marketing tools, transaction management and business intelligence.

For more information about this report series or the data, email Insights@LightBoxRE.com