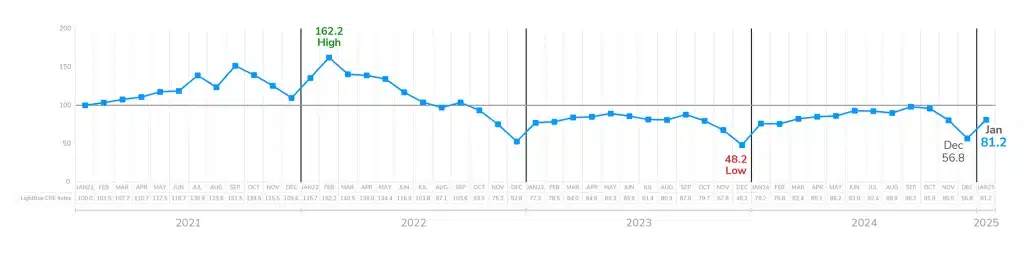

The LightBox CRE Activity Index reflects a robust rebound in January 2025, underscoring renewed market momentum following the subdued close to 2024. January was marked by the devastation of the Los Angeles fires, continued health in the labor market, the Fed’s pause on a fourth interest rate cut, the start of federal job cuts, and a 30-day reprieve on tariffs on Canadian and Mexican goods. Against this backdrop, the Index surged to 81.2, a substantial increase from 56.8 in December 2024, and just above 80.5 in November, signaling a decisive shift in market momentum. Notably, the January reading also outpaced the 76.2 recorded in January 2024, reinforcing a clear upward trajectory in investor confidence and transactional velocity. This resurgence indicates strengthening capital deployment, increased deal flow, and a recalibration of market expectations, positioning the CRE sector for sustained growth in the coming months as the market keeps a close eye on federal policy developments that could have implications for CRE lending, employment, interest rates, and general confidence.

Double-Digit Growth in Supportive Functions Lifts January Index to 81.2

The five-point year-over-year increase was driven by growth in the underlying key performance indicators. Environmental due diligence and lenders’ demand for commercial appraisals increased by 15% and 16% over Q4, respectively, and property listings on the RCM platform more than doubled.

Monthly LightBox CRE Activity Index (January 2021 – Present)

Manus Clancy

Head of Data Strategy

LightBox

“The January rebound reflects growing optimism that market conditions are stabilizing. Despite macroeconomic uncertainty and policy concerns, buyers and lenders are taking a more active approach as interest rates hold steady and new investment opportunities emerge.”

Outlook for 2025: The Tide is Turning

Declarations that the CRE market has bottomed out—especially for beleaguered legacy offices—are leading investors to confidently seek discounts. Institutional investors showed increased confidence in the CRE market in January with 43 transactions worth more than $100 million, but volatility and the rapid pace of news from Washington, D.C. are keeping some investors guarded. At the close of January, news broke that the GSA plans to terminate 7,500 leases, even as federal workers are mandated to return to the office, leaving uncertainty ahead for that asset type in GSA-owned property markets like D.C. The CRE market continues to be a nuanced market with pockets of opportunity (and expected losses) by MSA and property type—with each transaction highlighting the need for data analysis and on-the-ground research.

- Monetary Policy: The Federal Reserve’s stance on interest rates remains a key determinant of lending and transaction velocity. Stability or reductions in rates could further support market recovery. The next FOMC meeting in March is expected to result in no rate change—barring any unexpected economic fallout with jobs and inflation.

- Sector-Specific Performance: Industrial and multifamily remain strong, while office properties continue to face headwinds. Retail properties have shown resilience in select markets.

- Investment Climate: Institutional investors and private equity firms are cautiously re-entering the market, seeking distressed opportunities and repositioning strategies.

With the LightBox CRE Activity Index rebounding in January, early signs point to an improving transactional landscape as 2025 unfolds. Continued monitoring of key indicators will be crucial f or understanding the pace and sustainability of this momentum.

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.