While appraisal volume remained stable throughout most of 2024, the market saw a late-year slowdown amid uncertainty surrounding future rate cuts, shifting federal policies, and tightening underwriting standards. Still, despite the Q4 decline, annual appraisal award volume finished 2% above 2023, reflecting ongoing activity in select property types and refinancing demand.

Key Q4 2024 Developments from the Appraisal Snapshot Report:

- In a promising shift for CRE lending, the Fed lowered interest rates two more times in Q4 after the September 50-basis point cut, bringing the total reductions for the year to 100 bps.

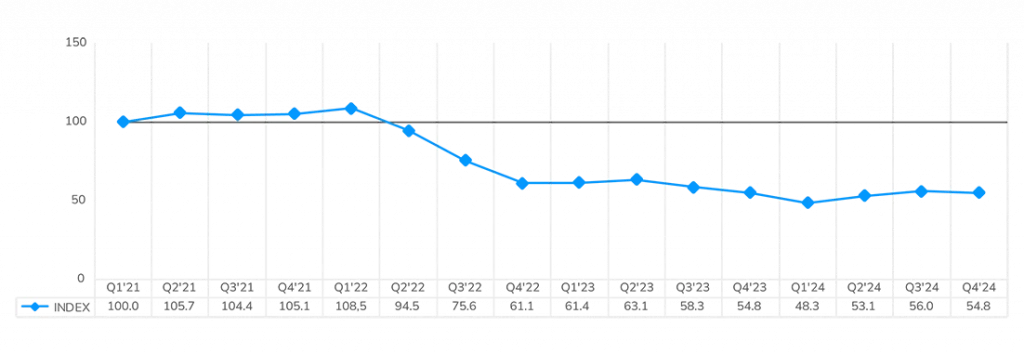

- After two quarters of increases, the Q4 LightBox Appraisal Index fell three points to 53.0 in Q4—nearly level with Q2 2024.

- Appraisal award volume (on a dollar basis) spiked 17% in October to set a new high-water mark for the year on the heels of the Fed’s first interest rate cut in mid-September, followed by declines in November and December to end the year 2% above 2023.

- The average appraisal fee per lender project increased slightly to $3,308 in Q4 compared to Q3’s $3,203 as volumes declined late in the year.

- Retail, industrial, office, and multifamily dominated 75% of all RFPs awarded in Q4, up from 73% in the prior quarter. Appraisal projects on land ranked in fifth place, accounting for another 8%.

Appraisal Index Declines to 53.0 in Q4

After a robust 17% month-over-month increase in October from September, likely the impact of the Fed’s 50-basis point rate cut, lender-driven appraisal volume declined by 22% in November and another 20% in December. The accompanying LightBox Appraisal Index registered at 53.0, a slight decline of three points quarter over quarter and a less significant 1.8-point drop year over year.

During the past six quarters, the Index has hovered consistently around the mid-50s reflective of a steady pace of demand for appraisal projects, but well below the market’s high point of 108 in Q1’22 just before aggressive rate hikes by the Fed.

This year’s market will likely be characterized by slow increases in appraisal demand related to banks’ return to lending as well as continued support of refinance activity as a growing swell of loans reach their maturity dates. With property prices stabilizing in many asset classes and geographies, borrower demand for loans to support new investment opportunities is likely to gain momentum.

LightBox Appraisal Index (Base Q1 2021=100)

Slow Start to 2025, Busier Second Half Expected

In the coming quarters, the market will have more specifics on the direction of federal policies and where interest rates are generally heading. As more pricing clarity comes into focus due to the work of appraisers, the market will see greater access to capital—especially by big banks with goals to increase lending activity for the first time in two years—more transactions, and a new cycle of redevelopment as CRE assets are repositioned for new uses.

Barring an unexpected market upset, the expectation for 2025 is for a moderate growth path for investment and lending as the market sees more opportunities than in 2024. The speed with which those with access to debt or equity capital reinvigorate investment activity will play a significant role in how quickly dealmaking ramps up in coming quarters, but it seems unlikely that the market will bounce back as quickly as it did post-COVID.

Despite ongoing challenges and rate uncertainty, the growing CRE market momentum, an expected moderate easing of interest rates, and a wave of loan maturities are anticipated to fuel greater borrowing demand and loan originations, particularly in the second half of 2025. However, lenders are expected to maintain a highly selective and cautious approach to underwriting given the significant market uncertainty. Appraisals will continue to play a critical role in an uncertain market given that asset appreciation is no longer guaranteed.

The LightBox CRE Market Snapshot Series, Q4 2024—Focus on Lender-Driven Appraisal Trends—presents data from more than 1,200 banks and credit unions across the United States and reflects industry benchmarks specific to lender-driven commercial property appraisal activity. The data are derived from LightBox applications Collateral360 and RIMS, which are used by financial institutions to manage and procure appraisals in support of property lending activity. The LightBox CRE Activity Index combines appraisal activity with environmental site assessments from LightBox EDR and property listings in LightBox RCM to create a composite of CRE transaction activity.

For more information about this report series or the data, email Insights@LightBoxRE.com