By: Head of Data Strategy at LightBox, Manus Clancy

Do you remember when Frank Sinatra made ‘Chicago (My Kind of Town)’ a staple of his tours?

January brought renewed interest in the Chicago office market after several high-profile sales we announced— again, coming with sizable discounts.

This week, Crain’s Danny Ecker reported that Glenstar and Wayzata, MN-based Patrick Halloran spent $68 million to acquire 200 S. Wacker Drive. The combination made the acquisition by acquiring a distressed $151 million loan and simultaneously flipping the ownership via deed-in-lieu. The sale represents $90 per square foot for the 760,000 square-foot office. The sale is a nearly 70% discount to the 2013 sales price of $215 million.

The news comes on the heels that Groupon’s former headquarters —a 1.6 million-square-foot office at 600 W. Chicago—was sold for $88.7 million, or just $55 per square foot. The property was 96% leased in 2023, but after Groupon terminated its lease early in 2024, occupancy dropped to 62%. The building last sold for $510 million in 2018, marking a steep decline in value. The buyer was 3Edgewood, a firm started by former Phoenix Suns owner Robert Sarver.

Also on the January “hit parade” was 550 W. Washington Blvd. The 372,000 square-foot West Loop office building sold for $50 per square foot to Brog Properties. It paid $18.5 million—an 83% discount to the 2013 sales price of $111 million.

LightBox Stats Show Remarkable Consistency

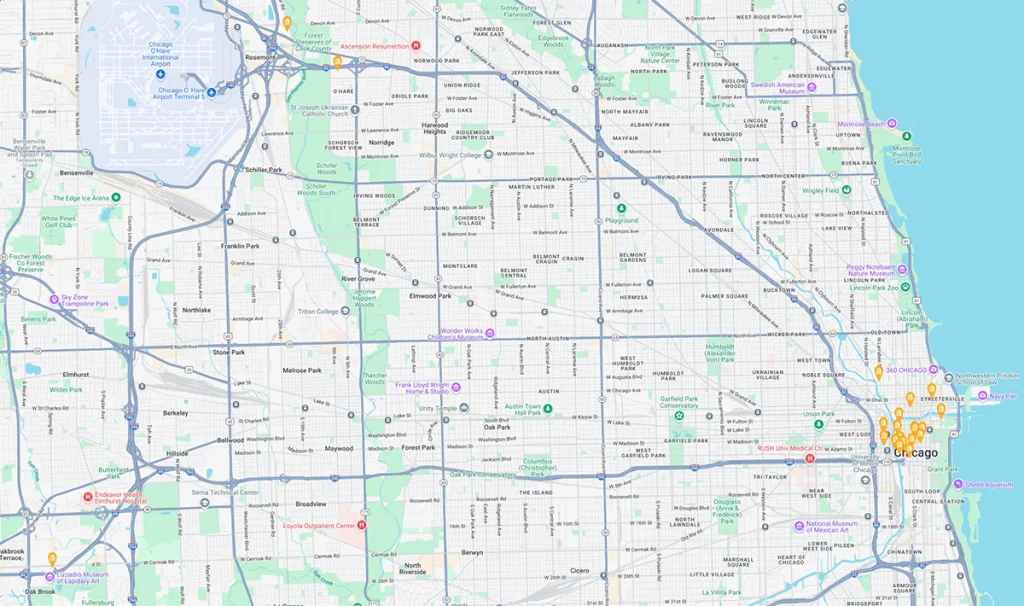

As we’ve noted on the LightBox CRE Weekly Digest Podcast, even though office valuations have tumbled by more than 50% over the last 30 months, office sales are taking place at a healthy pace in many U.S. cities. This is certainly true of Chicago and the surrounding areas where about 30 office sales have taken place.

(This is a big departure from 1990 and 2008— the last two great CRE recessions. During those periods it took years for significant price discovery to take place.)

Of the properties located in or close to the Chicago CBD, the average sales price per square foot has been $75. However, excluding the two major mixed-use property sales where the retail component is highly valued, for this the retail segment was highly valued, the price per square foot drops to $71. About half of the sales “clustered” between $54 per square foot and $89 per square foot.

On the discount front, the average price discount (dollar weight) was 71%. Almost two-thirds of the sales came with discounts of 60% to 90%.

Plenty of Buyers

The buyer pool has not been small either. Below is a list of buyers that have decided to make Chicago ‘their kind of town.’ Some of these buyers have jumped in the pool more than once.

So, while sellers might be disappointed by the prices they are seeing, there is no shortage of sellers. Nor is there a shortage of buyers willing to take the plunge.

Recent Buyers of Chicago Offices at Deep Discounts

- 3Edgewood

- 601W

- Beacon Capital Partners

- Brog Properties

- Chicago Development Partners

- Franklin Partners

- FRI Investors

- Glenstar and Patrick Halloran

- Honore Properties

- Igor Gabal

- Murphy Development Group and InSite Real Estate

- Namdar Realty Group and Mason Asset Management

- North American Real Estate

- Onward Investors

- Prime Group and Capri Interests

- Sanjay Gandhi

- Triple Double Real Estate

For a copy of the underlying data, reach out to the CRE Weekly Digest team at podcast@lightboxre.com