Lending, Debt, & Equity

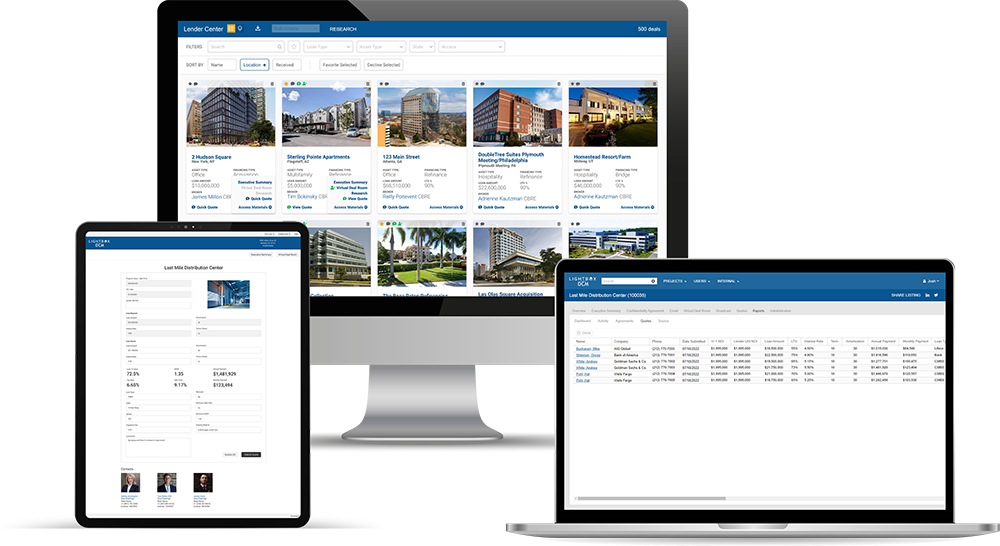

Debt Capital Markets: Comprehensive, Single-Source Platform Connecting Brokers with Lenders

Debt Capital Markets (DCM) is designed to help debt and equity providers market CRE deals, engage with capital sources, and efficiently track quotes from lenders. Over 95,000 lending professionals engage with DCM on a daily basis.

Debt and Equity Providers

Marketing & Workflow | Data & Insights | Enhanced Lender Engagement

Debt Capital Markets (DCM) is an innovative solution powered by the same cutting-edge technology that brought you Real Capital Markets. Designed to serve all your capital needs, DCM provides a comprehensive, single-source platform that connects debt and equity brokers with lending professionals. With DCM, you can access the best financing terms available for your CRE deals while benefiting from a streamlined process.

Whether you’re looking to market your CRE deals, engage with capital sources, or efficiently track quotes from lenders, DCM is your go-to-market platform and workflow solution for managing your financing needs.

DCM by the Numbers:

95,000+

lending professionals in the database

7,600+

sources of debt capital across the U.S

81%

of Top 500 lenders in the country

Key Benefits

Marketing Efficiencies:

DCM increases marketing effectiveness and simplifies workflows, saving you time and resources

Unmatched Delivery Success:

Achieve over 99% email deliverability rate on marketed opportunities, the highest in the industry

Lender Engagement Tracking:

Capture and track lender activity through every stage of the financing process

Optimized Production:

Secure the financing you need faster, enabling you to close more deals with confidence

Exclusive DCM Advantages: