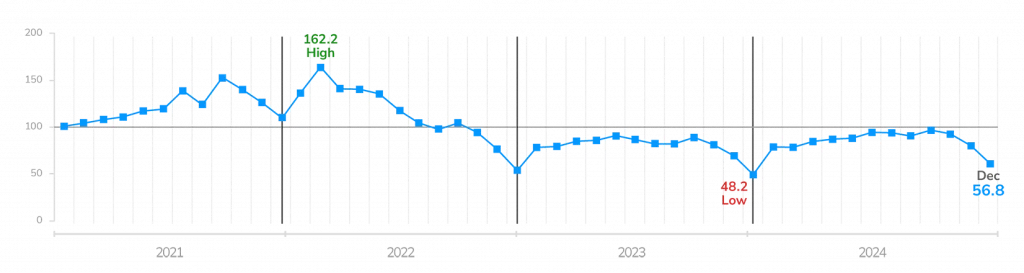

As 2024 ended, the LightBox CRE Activity Index reflected both the seasonal slowdown typical of December and heightened market uncertainty. The Index fell sharply by 23.7 points month-over-month, closing at 56.8—but still nearly nine points higher than the four-year low point in December 2023 (48.2). The Index is an aggregate measure of how momentum across critical functions like property listings, appraisals, and environmental due diligence is shifting in response to market forces.

While seasonal moderation is expected at year-end, the December month-over-month decline was steeper than the average 19.3-point drop seen over the prior three years. Contributing to the decline were rising treasury yields fueled by investor concerns over the federal deficit, the potential for new tariffs, and persistent inflation. The 10-year Treasury yields increased by 40 basis points, from 4.2% at the end of November to nearly 4.6% by year-end. Additionally, despite a third Fed rate cut in mid-December, expectations for further cuts in early 2025 were tempered, which likely added to market hesitancy.

Pulling the lens back a bit for broader context, from 2024’s high of 98.2 in September, the near near-point increase year-over-year highlights a wider trajectory of recovery and momentum despite short-term volatility.

Optimism usually abounds at the start of a new year and that’s certainly the case today. Despite the volatile fourth quarter and continued uncertainty, the pervasive market sentiment is still largely bullish about CRE lending and investment in 2025.

Broad signals are pointing to a positive market shift gaining momentum. Among them, investors are demonstrating a willingness to deploy capital, encouraged by a round of deals that closed late in 2024 as rates declined and a loosening of debt-side purse strings as banks reinvigorate lending for the first time in years. In an early sign of momentum building in the investment market, the number of new listings on the LightBox RCM platform, while generally light in December, doubled in the final two weeks of 2024 compared to the corresponding period of 2023.

December Index Falls to 56.8 as Treasury Yields Rise

The recent trajectory of the LightBox CRE Activity Index over the past few months collectively reflects how the momentum behind CRE activity in the property listings, environmental due diligence, and appraisal segments is responding to shifting sands in the market. After the Fed’s first interest rate cut in September, the Index spiked to its 2024 high as momentum built for a wave of transactions that continued into October. After that, the typical seasonal slowdown in November and December also reflected a shift as the post-election optimism gave way to federal policy speculation and the market’s collective adjustment to a slower than expected reduction in interest rates in 2025 (see chart).

More encouraging, however, is the dramatic 8.6-point improvement in the CRE Activity Index year over year, fueled by double-digit increases in the property listings and environmental due diligence components of the Index. This is a notable improvement over year-end 2023 when transactions were thwarted by high interest rates, tight debt capital as lenders held fast to the reins of new originations, and sellers were reluctant to list properties given the lack of pricing clarity.

Leading into January, it is encouraging to see the momentum of property listings activity building as sellers put assets on the selling block in the final weeks of a tumultuous fourth quarter. At the ground level, sentiments from leading CRE professionals on the LightBox Market Advisory Councils for capital markets and environmental due diligence report seeing more portfolios, higher interest from institutional investors, and reengagement from clients who were in wait-and-see mode for much of 2024.

Monthly LightBox CRE Activity Index (January 2021 – Present)

OUTLOOK: Optimism Builds for 2025 Forecast as the FOMO Mindset Takes Root

Driven by the mix of seasonal slowness, as well as factors unique to this stage of the market at year-end, the CRE Activity Index ended December lower than expected. Looking back, 2024 was slower than most CRE professionals had forecast based on a widespread expectation that falling interest rates and the related uptick in dealmaking would have gotten underway earlier in the year than September. Instead, inflation proved more stubborn than forecast and the election and related uncertainty failed to deliver the stability that the market craved.

As 2025 gets underway, despite December’s volatility, anecdotally, the word on the street is that investment-related activity is gaining steam as eager investors get more comfortable shopping around for opportunities and lenders re-engage as rates slowly come down. With the start of the Fed’s rate easing cycle and the presidential election in the rear-view mirror, some of the uncertainty around monetary policy going forward is dissipating.

The “Balanced Sheet”: An Even Mix of Headwinds and Tailwinds

While there are differences by degrees and myriad forecast scenarios, most CRE professionals agree that 2025 will be better than 2024 for transaction activity, despite some persistent market challenges. Preliminary findings from LightBox’s Q4 2024 survey of Market Advisory Council members suggest a promising outlook for 2025, with CRE transactions expected to grow between 10% and 35% and CRE lending projected to increase between 15% and 40%.

Among the greatest headwinds clouding an otherwise bullish forecast are continued concerns about the elevated 10-year Treasury yield, the looming federal budget deficit, and the lingering sticky inflation, particularly given the possibility of tariffs this year, that could derail any further rate cuts.

Major tailwinds that are driving growth forecasts in CRE this year include the still-strong economy which maintains an average quarterly growth around 2.8% in recent quarters, a solid jobs market and unemployment at historically low levels.

Manus Clancy

Head of Data Strategy

LightBox

“After more than a year of holding off for interest rates to decline, the market is seeing a resurgence of confidence. Investors with pent-up demand, especially those with their own capital, are pursuing deals reminiscent of those that drove late 2024 transactions. Additionally, the measured return of big banks is anticipated to boost activity across asset types, with multifamily, data centers, and retail showing strong momentum, while some office markets continue to stabilize.”

As more transactions close, the bid-ask gap that challenged deals over the past few years will narrow further and entice more buyers and sellers into the market. Each new round of dealmaking helps establish a bottom in the market as prices become more predictable. As the value correction continues, investors will likely see more long-term opportunities than in 2024 and will grow increasingly more comfortable chasing attractive opportunities. Sellers, either through forced transactions or by choice, will be incentivized to move properties into play. Lower construction starts in some segments will also improve the supply-demand balance and drive rent growth, particularly in multifamily. The market will also see a wave of distress this year as the volume of loan maturities grows, particularly in office and multifamily. As many as $500 billion in CRE loans are set to mature in 2025, and competition for debt capital will intensify.

ABOUT THE MONTHLY LIGHTBOX CRE INDEX

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.