The expectation of the long-awaited first interest rate cut in more than four years, coupled with growing investor impatience to deploy capital in the final months of 2024, drove a strong month for the LightBox CRE Activity Index. This aggregate measure of activity in commercial property listings, environmental due diligence, and appraisals collectively tracks shifts in the velocity of key functions that support CRE transactions.

The most significant development in September was the Federal Reserve’s decision to lower interest rates for the first time since March 2020. While the rate cut itself wasn’t a surprise, the 50-bps magnitude was, given that higher rate cuts typically signal a market in distress. Not surprisingly, the CRE lending and investment market responded favorably to the news, but the near-term forecast is not without its storm clouds. Recent issues, such as the now paused strike at East and Gulf ports—where a temporary agreement is in effect until January 15, 2025—the escalating conflict in the Middle East, the devastation caused by Hurricane Helene, and the impending November elections, all pose risks that could hinder positive momentum for CRE activity in October and throughout the fourth quarter.

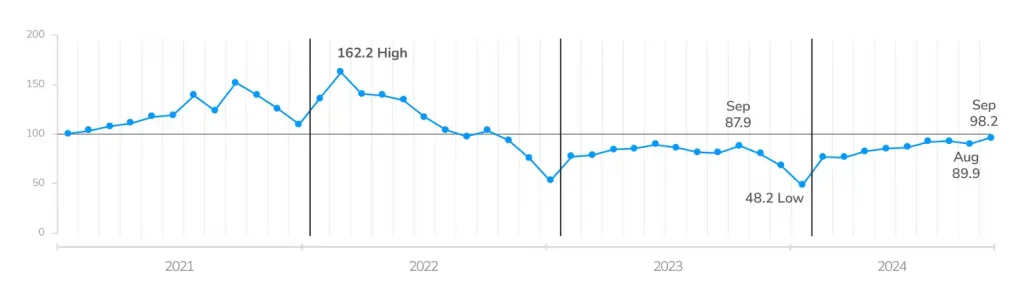

September CRE Activity Index Increases More than 8 Points to 98.2

After August’s Index of 89.9 ended a five-month streak of increases that took root in March, September’s Index resumed a trajectory of increasing velocity, coming in at 98.2, an increase of 8.3 points. The increase was fueled by an uptick in commercial property listings, which typically happens after Labor Day as the market settles into the final months of the year. The Fed’s higher-than-expected interest rate cut sent a strong signal to the market that a new cycle is underway with borrowing costs falling for the first time in more than four years. Environmental due diligence and appraisal activity also increased modestly over August in an early sign of the lending and investment engines gaining steam heading into Q4. If more assets move into play and lenders re-engage, the Index in the coming months will reflect the market’s growing momentum as 2024 closes out.

Monthly LightBox CRE Activity Index (January 2021 – Present)

First Interest Rate Cut Opens the Door to a New Chapter for CRE

For much of this year, the market was essentially left to speculate about when the Fed would vote to lower rates. This uncertainty left banks holding tight to the reins on new loan originations, while private equity firms formed debt funds to fill the vacuum in lending at a time when the market faces trillions of dollars in impending maturities and the prospect of more loan defaults.

September’s biggest development was the Federal Reserve’s first interest rate cut since 2020, which spurred a positive reaction from the CRE lending and investment markets.

Manus Clancy

Head of Data Strategy

LightBox

“The 50-bps cut was an unexpected but welcome surprise for CRE, providing a psychological boost. Even a 25-bps cut would have signaled to the market that a new era of capital deployment has finally begun.”

With lower rates and an increase in transactions comes more clarity on property pricing and an urgency to place capital before prices in some asset classes and geographies increase. Any borrowers who originated floating rate loans at the market high point of 2021 and early 2022 will see at least some moderate initial relief from rates that are no longer climbing and adversely impacting their cash flow and debt service coverage ratio (a measure of a property’s income generation relative to debt obligation).

Declining rates will begin to lower costs for borrowers with maturing loans, many of which from 2023 and 2024 were extended in the hope of refinancing in a more favorable interest rate environment. Thus, the increasing momentum in CRE activity since March (notwithstanding the small dip in the CRE Activity Index in August) is likely to gain traction as the universe of buyers expands, debt capital costs fall, and more properties begin to change hands either as traditional or forced sales.

Psychological Impact of the First Rate Cut Clouded by Growing Risks

The strength of the September CRE Activity Index, coupled with the likelihood of more rate cuts at the November and December Fed meetings, lays the foundation for stronger lending and transactions activity through year-end and into 2025. The latest prediction from the Mortgage Bankers Association (MBA) is that total commercial and multifamily mortgage borrowing and lending will end 2024 at $539 billion, a 26% increase above 2023. Given that Q2 lending increased only 3% year over year, the MBA is anticipating a significant uptick in lending and refinance activity now that rates are falling. While short-term borrowers could hold off for future rate cuts, long-term investors are likely to move in quickly to take advantage of a growing number of opportunities while liquidity is still constrained. Despite a cautiously optimistic outlook for the Index in Q4, there are a growing number of risks that deserve attention.

First is the threat of inflation. Lower interest rates translate into lower borrowing costs, which could drive a rise in already-elevated housing prices. Housing is an important component of the Consumer Price Index (CPI) so any uptick in housing threatens to reverse the 24-month decline in CPI. For now, big supply chain snags have been averted with the suspension of the strike by 45,000 U.S. dock workers on the East Coast and along the Gulf. But the 3-day strike was a reminder of the pandemic supply chain problems that fanned the flames of inflation in 2022. Although Fed Chair Jerome Powell expects the central bank to lower rates by another half percentage point by the end of the year- somewhat lower than markets had been anticipating, much depends on what the data shows in coming weeks.

The September jobs report showed that the pace of hiring picked up strongly last month and the unemployment rate ticked down, a sign of a resilient labor market. The next round of jobs data, to be released November 1st, could reflect any layoffs triggered by Hurricane Helene. Any evidence of inflation rearing its ugly head, or a weakening of the labor market could complicate future rate cut decisions.

Second, the upcoming election is just over a month away, and issues like inflation, housing, and job creation will be top of mind. In early September, consumer confidence plunged after August data showed news of a weakening job market and rising costs of living. But the October jobs data was more encouraging. If November’s labor market data shows a softening in October, it could erode market confidence as the election nears.

Last, although the market has thus far been able to avoid the widespread distress of past downturns, pressure is building. Colliers estimates that distress is on the rise with newly troubled loans now running at a pace five times pre-COVID levels.

The Rate Cut is Just the Beginning for CRE

Despite the market’s challenges and risks, the rate cut triggers the start of a new growth cycle for CRE. The strength and duration of the next chapter remains to be seen. As the market gets more clarity on the future path for interest rates, sentiment will improve, the pool of investors filing non-disclosure agreements will expand, and stronger transaction and lending velocity will follow along with lower cap rates, higher property valuations, and net operating income (NOI) growth. While challenges persist, the market is now seeing growing hope and enthusiasm that has been largely absent for several years. These pivot points in the CRE market cycle always deliver an interesting mix of risks and opportunities.

About the Monthly LightBox CRE Index

The LightBox Monthly CRE Activity Index is an aggregate that represents a composite measure of movements across activity in appraisals, environmental due diligence, and commercial property listings as a barometer of broad industry shifts in response to changes in market conditions. To receive LightBox reports, subscribe to Insights.