Appraisal Awards Surge in April and May only to Tumble 26% in June

The second quarter of 2024 delivered the second consecutive quarter of increases in lender-driven appraisal volume. Although modest, the increases were particularly notable coming on the heels of two quarters of decline in the second half of last year. An analysis of data from LightBox Collateral360®/RIMS® platforms points to a 6.8% increase in appraisal volume in Q2 2024 compared to Q1 and a nearly 5% increase compared to one year ago.

These results are consistent with the latest LightBox CRE Activity Index, which increased in June for the fourth consecutive month. The Index reflects Q2 dealmaking by opportunistic investors, combined with an early round of loan sales by banks.

For appraisers eager to index their own Q2 2024 activity against industry benchmarks, our Q2 CRE Market Snapshot for the appraisal segment highlights the latest trends and forecasts:

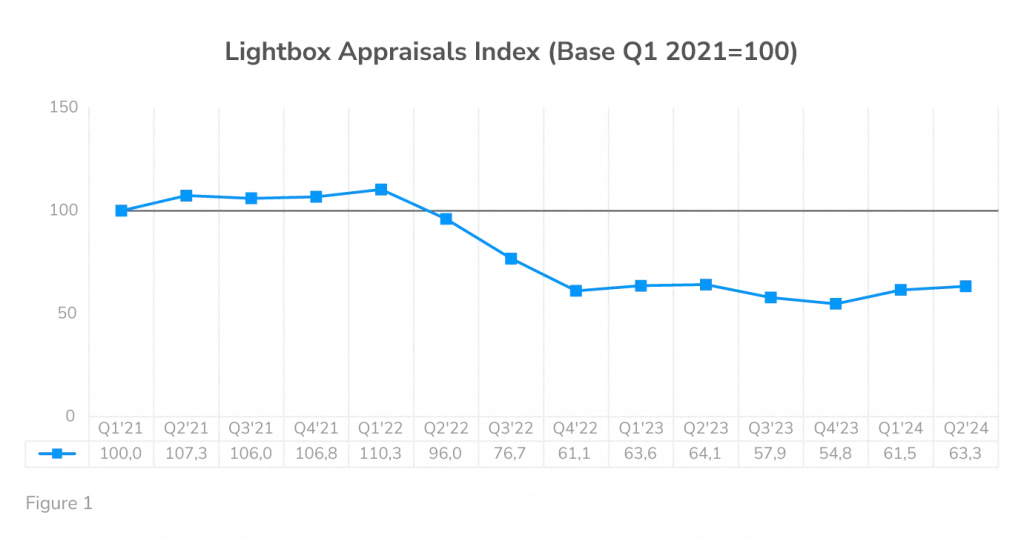

- The LightBox Appraisal Index increased 1.8 points QoQ, ending Q2 at 63.3—just below 64.1 at this time last year.

- Appraisal award volume (on a dollar basis) increased 6.8% QoQ, while the number of RFPs from banks for appraisal projects grew a more modest 2.9% as work on distressed assets and loan sales heats up.

- The average appraisal fee of $3,213 was a slight 3.5% uptick over the prior quarter, and a more significant 5.2% over $3,055 in Q2 of last year.

- Pressure to compete based on turnaround time continues to be intense with the average time in Q2 0.4 days faster than one year ago.

LightBox Appraisal Index Likely to Hover Around 60 as Market Awaits First Rate Cut

CRE lending continues to be very risk-averse and challenging given still-high interest rates, and the slow transactions market is making property valuations more difficult as appraisers have fewer comparable transactions to reference. Standard points of reference typically used by appraisers, like net operating income, vacancy rates, and cap rates have all been upended by recent market shifts, but if the recent round of deals in the second quarter—especially distressed asset transactions—continues, appraisers will have access to a broader universe of recent sales comparables, adding to the reliability of valuations.

Recent sales activity is encouraging, and reflective of optimism about the market’s flight to quality. As noted by Jeff Garvin, Chief Appraiser at Bank OZK, in a panel at LightBox’ PRISM conference in Dallas, “While Class B and low-A grade properties face challenges, I’m seeing high-quality office projects seeing an uptick in leasing. Recent transactions in stabilized properties are beginning to reset the market and there are billions in capital ready to invest once the conditions are right. Distress, on the other hand, will be a slow boil as the volume of loans in distress increases and needs to be dealt with.”

Near-term headwinds impacting the forecast include geopolitical uncertainty, inflation concerns, the unknown timing and trajectory of interest rates, and of course, the upcoming presidential election. That, combined with seasonally slower Q4s in recent years, puts downward pressure on the forecast. In the short term, notwithstanding any significant market developments, the LightBox Appraisal Index will likely remain relatively flat through the end of the year, dependent on the timing of any rate cut and only a moderate disruption from the election.

The LightBox CRE Market Snapshot Series, Q2 2024—Focus on Lender-Driven Appraisal Trends—presents data from more than 1,200 banks and credit unions across the United States and reflects industry benchmarks specific to lender-driven commercial property appraisal activity. The data are derived from LightBox applications Collateral360 and RIMS, which are used by financial institutions to manage and procure appraisals in support of property lending activity. The LightBox CRE Activity Index combines appraisal activity with environmental site assessments from LightBox EDR and property listings in LightBox RCM to create a composite of CRE transaction activity.

For more information about this report series or the data, email Insights@LightBoxRE.com