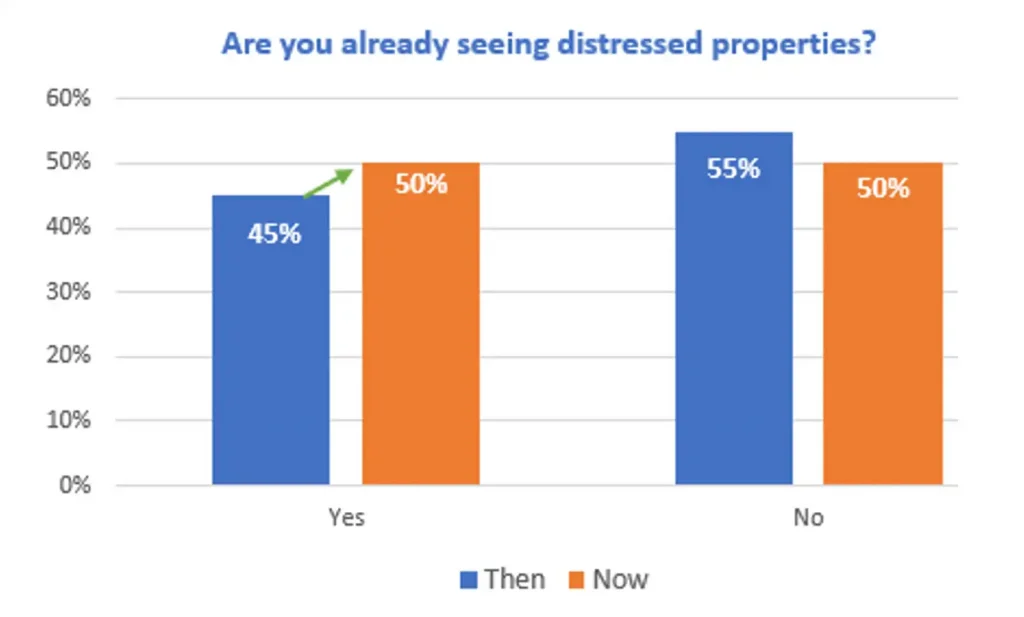

In our continuing coverage from the LightBox Q4 Market Sentiment Survey, we take a look at what the investor, broker, lender, appraiser, and environmental due diligence consultant respondents shared in terms of emerging CRE distress. In a moderate yet revealing sign, the percentage of respondents seeing distressed properties rose by five percentage points since the LightBox Mid-Year Market Sentiment survey:

This uptick is not surprising, given the uncertainty in the economy and the challenges that the new normal in interest rates is causing for both loan refinancing and originations for property investment. While relatively solid cash flow performance has limited distressed assets so far, the survey responses characterize an industry bracing for a ramp-up in 2024 as owners and lenders are forced to deal with the new reality of higher rates, rising operating costs, and a reset of property values.

Asset Class Overview: Office Struggles for Clarity

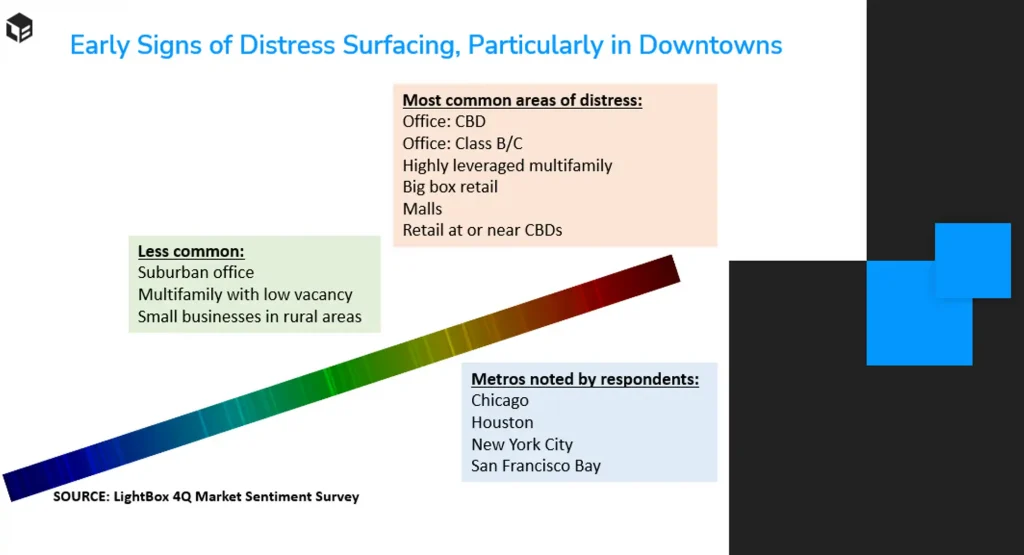

Asked to share where distressed properties were surfacing, respondents not surprisingly pointed to downtown office towers, particularly Class B and C properties, along with highly leveraged multifamily properties, big box retail, malls, and downtown shopping centers. Some respondents noted seeing early signs of distress starting to emerge in suburban office, multifamily with low vacancy and struggling small businesses in rural areas. While many respondents broadly commented that downtown properties are experiencing distress, a few specific metros were noted by many respondents; namely, the Bay Area, Chicago, Houston, and New York City.

One of the greatest sources of uncertainty in the market—and one of the largest allocated asset classes—is in the office sector as lenders and equity investors struggle with low demand, high risk and the challenge of how to accurately price assets. After the waiting game in 2023 as all eyes were on the Fed for signs that interest rates were peaking, owners are starting to turn the keys over on troubled office assets, a trend likely to continue over the near-term as leases and loans expire and employers reduce their space needs as they adjust to the new work paradigm. A recent forecast by CBRE Econometric Advisors estimates that the office vacancy rate will peak at 19.7% by the end of next year due to a likely recession and a reduction in office-using jobs. Much of the rise in vacancy will be limited to the most troubled 10% of U.S. office buildings. Rising vacancies will make it even more challenging for office owners to pay off their loans as profits take a hit in a market with higher borrowing costs and falling building values. On the topic of office, this is what a few respondents shared:

“The office market is still distressed and as mortgages mature all real estate classes should see difficulty due to rising interest rates.”

“Office property loan maturities are a huge concern as the ROI is still significantly down, and banks are not going to be able to work out deals on dealing with distressed assets.”

Distress Set to Rise in 2024

While more distressed assets in 2024 are likely, the unknown lies in just how much—and when? In 2023, sellers were in a holding pattern and refi borrowers were waiting for interest rates to turn a corner as buyers waiting for the declines in prices they needed to justify target returns and borrowers with maturing loans worked with lenders on workouts and extensions to avoid losses and delay distress. Loan maturities will be a major focus for the market in 2024.

Given Federal Reserve Chairman Powell’s latest position at the December FOMC meeting, interest rates will remain high over the near-term, so as loans mature, the market will be dealing with more distress. If the economy weakens rapidly and fundamentals like rents, occupancies, and cash flows deteriorate, then more owners will be incentivized to sell. The wave of commercial property loans maturing in 2024 will be a challenge, particularly those that originated when prices were at record highs and rates were at record lows coming out of the COVID downturn. Opportunistic investors are poised to chase assets that are ripe for redevelopment into alternative uses, particularly Class B and C office and outdated shopping centers. Many respondents reference a reset in the market ahead:

“What will cause distress in 2024 are higher operating expenses, higher cap rates and lower valuations.”

“I expect to see a significant volume of distressed assets as loans reset to current interest rates. Many loans will not be able to be refinance without equity, and many borrowers don’t have equity to put in.”

The dynamics of commercial property dealmaking will need to pivot in 2024 as investors come to terms with the reality that financing is no longer cheap and high returns will be more challenging to realize, particularly as prices reset. The next blog in this series delves into how respondents’ top concerns differ across industry segments, with loan maturities top of mind across the board, supporting the expectation that the 50% of respondents who are already seeing distress properties will see even greater distress in 2024.